TL;DR – How to Start Selling Online in China (2025)

China is the world’s largest e-commerce market, with over 1 billion internet users and more than 2.2 trillion USD in online sales.

Foreign brands can enter via cross-border e-commerce (Tmall Global, JD Worldwide, etc.) or by building a local presence on major platforms like Tmall, JD, Douyin, Xiaohongshu and Pinduoduo.

To succeed, you need clear market research, a logistics plan (overseas or mainland storage), the right platform mix, and a trusted local partner such as a TP or e-commerce agency.

This guide walks you through key data, a pre-launch checklist, three essential steps (research, logistics, platform choice), and how to leverage KOLs, multichannel strategies and localisation to grow sales.

China remains the world’s largest and most dynamic e-commerce market, with over 1 billion internet users and a highly digitalized consumer base. For international brands, this represents not only massive potential in terms of volume and sales margins, but also a unique opportunity to tap into a mobile-first, trend-driven market. As a result, more global companies are entering China through cross-border e-commerce platforms and localized digital strategies to stay competitive and meet evolving consumer expectations.

China has become the largest online market in the world

E-Commerce in China has established itself as the most profitable industry in the country, whether for small businesses as well as larger ones, all thanks to the influence of the Chinese market throughout the world.

Throughout the article, we will discuss e-commerce in detail, but not before examining the difference between electronic commerce and traditional commerce in China. After that, we will examine the specific steps necessary to sell in China and some of the keys to e-commerce in China.

If you are interested in introducing your company or brand to this market, do not hesitate to contact InfluChina, an e-commerce agency in China whose purpose is to promote the presence of foreign companies in China through strategic collaborations with Chinese influencers.

This guide is designed for international SMEs, e-commerce brands, Amazon and marketplace sellers, and established retailers who want a practical, step-by-step roadmap to start selling online in China. If you are interested in introducing your company or brand in this market, do not hesitate to contact InfluChina, an e-Commerce agency in China.

1. E-commerce in China vs Traditional Retail: Why Online Leads

To distinguish between e-commerce and traditional commerce, it’s important to recognize that traditional commerce involves face-to-face, physical interaction between buyers and sellers. E-commerce, on the other hand, enables transactions without direct contact, allowing consumers to purchase products from virtually anywhere, regardless of geographic distance.

In China, the level of digital transformation is among the highest in the world. As of 2024, over 1.07 billion Chinese citizens are internet users, with 99% accessing the internet via mobile devices. This mobile-first behavior has played a crucial role in shaping the country’s e-commerce ecosystem.

When comparing e-commerce in China to traditional commerce, the difference is further highlighted by the scale: in 2023, China’s e-commerce sales exceeded 2.2 trillion USD, dwarfing figures from other markets, including the United States, which reached approximately 1.1 trillion USD. These figures reflect the dominance and maturity of China’s digital economy, where online shopping has become deeply integrated into everyday life.

China’s e-commerce sales surpassed 2.2 trillion USD in 2023, confirming its position as the world’s digital commerce powerhouse.

2. Key Chinese E-commerce Data (2024–2025)

To get a good look at the current Chinese e-commerce data, We must take into account that, as detailed in the report Paycomet, that 77% of China’s total sales are through the Internet, ranking first compared to 44% in South Korea, which is in second place.

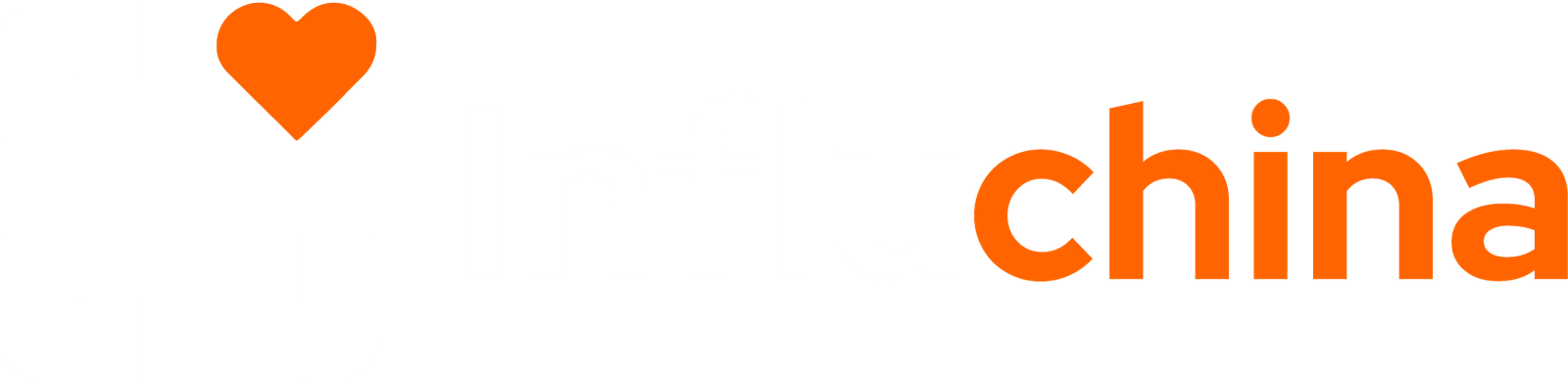

Furthermore, as we see in the following graph, the online shoppers in China increase exponentially each year, having reached 884 million by the end of 2023, according to ICEX data.

On the other hand, last year, the so-called “titans” of e-Commerce in China increased sales in Spain by 40%. In 2023, the average spending per customer in Miravia was 30 euros, 24 euros on Temu and 35 euros on Amazon.

Online shoppers in China are increasing exponentially every year, having reached 884 million by the end of 2023

Finally, to clarify the importance of this emerging market, it is worth noting that revenues are expected to grow at an annual rate of 12.42% by 2027, resulting in a projected market volume of $2.375 billion.

Pre-launch Checklist: Is Your Brand Ready for China E-commerce?

Before you choose a platform or open a store, it’s important to confirm that your brand is truly ready for the Chinese market. Use this quick checklist to reduce risks and avoid expensive mistakes later:

Define your China goals & budget

Are you testing the market or committing long term? Clarify revenue targets, testing period (e.g. 6–12 months), and the budget you can allocate for store setup, marketing and logistics.Check product–market fit

Review how similar products are positioned on Tmall, JD, Douyin or Xiaohongshu. Analyse price ranges, packaging formats and hero SKUs that perform best in your category.Protect your brand & trademarks

Register your brand and trademarks in China as early as possible to prevent copycats or “trademark squatters” from using your name on local platforms.Review regulations & import restrictions

Confirm if your products fall under sensitive categories (e.g. cosmetics, supplements, food). Each category has specific registration, labelling and import requirements.Decide on cross-border vs domestic model

Decide whether you will sell via cross-border e-commerce (shipping from overseas/ bonded warehouse) or set up local inventory in mainland China. This choice affects pricing, delivery speed and platform options.Plan customer service in Mandarin

Chinese shoppers expect fast responses via chat and after-sales support. Ensure you have a partner or internal team that can handle customer service in Mandarin.

If you can tick most of these points, you’re in a much stronger position to move ahead with the step-by-step plan that follows.

3. How to Start Selling Online in China: Step-by-Step

Now that we know what e-commerce is in China and the differences between electronic commerce and traditional commerce, we can move on to the steps to follow to sell in China effectively.

These steps are of great importance and must be followed meticulously, especially if you are a company or organization that does not have any presence in the Asian giant. From InfluChina, we propose the following key points.

Step 1: Market Research in China (Know Your Category & Consumers)

The first and indisputable step to selling in e-commerce in China is to study your market and sector in the Asian country in detail. Without having this knowledge, you will not be able to establish good competitive strategies that take you to the highest.

The first and indisputable step in selling in e-commerce in China is to study your market and sector in the Asian country in detail.

It is crucial that you start with a competitive and product analysis: know all the competitors, understand what and how they do it, what are the strategies that lead them to be at the top, and what are their effective ways of promoting the products and services that your company offers.

It is crucial to have a market study previously carried out to define the strategy and to be able to make informed decisions justified by data. If not, you are basically going blind in a market that is so complex and different from the West.

By carrying out a good market study, you will be able to know and identify all the desires and consumer needs for the Chinese audience, analyze the competition, evaluate marketing channels, and adapt your products to the harsh demands of the Asian market.

Key Market Research Actions for China

- Analyse your category on major platforms (Tmall, JD, Douyin, Xiaohongshu, Pinduoduo) to see which products and brands perform best.

- Identify your target consumer segments by age, city tier and income level, and how they currently shop online.

- Review local pricing and hero SKUs to understand acceptable price ranges, package formats and best-selling product variants.

- Check regulations for your product category, especially for cosmetics, food, health supplements or products with specific certifications.

Study local competitors’ positioning and messaging so you can define a differentiated value proposition for the Chinese market.

China’s economy is rapidly expanding, with increasingly intense competition, significant socioeconomic and regional disparities, and constant government regulations. Therefore, consumer-oriented companies must conduct market research in China to develop appropriate market strategies.

We suggest carrying out a market study with the following steps:

1.Analysis of your sector:

- Market summary (history and current situation).

- PEST analysis (political, economic, social, and technological factors).

- Market trends.

- Online and offline distribution channels.

- Analysis of the different product formats in your sector.

2.Analysis of target consumers:

- Analysis of consumer behavior.

- Consumer journey (B2C).

- Consumer analysis by geographical areas.

- Moments of consumption and consumption barriers.

- Purchasing power by cities.

On the other hand, in addition to executing this competitive and product analysis and knowing the regulations, it is essential to know all the restrictions specifically existing ones, which are not few, and study the import processes of your particular sector. The third step would be:

3.Competitive analysis:

- Analysis of products, sales formats, and prices.

- Presencia online vs. offline.

- Digital strategies and marketing campaigns.

It is essential to know all the specific restrictions and study your particular industry import processes.

Step 2: Storage and Logistics Planning for Cross-Border & Domestic Sales

The next step to effectively selling in China is to clearly define storage and logistics locations. You can choose to have the storage in your home country or in China, and based on that decision, you can make cross-border e-commerce basic electronic commerce.

Key Logistics Decisions for Selling in China:

- Decide between cross-border and domestic logistics, depending on your budget, product shelf life and desired delivery times.

- Choose your storage model: ship directly from your home country, use a bonded warehouse in China, or store products in a local 3PL warehouse.

- Map your full fulfilment flow, from order placement to last-mile delivery and returns, including who is responsible at each step.

- Estimate shipping and customs costs per unit so you can calculate realistic margins and final retail prices.

- Plan for returns and customer care in Mandarin, as Chinese consumers expect fast resolutions and clear communication.

Cross-border vs Domestic E-commerce in China (At a Glance)

Aspect | Cross-border E-commerce (CBEC) | Domestic E-commerce (China-based) |

Legal setup | Can sell with overseas entity via CBEC platforms | Usually requires Chinese entity or local partner |

Setup speed | Faster to launch, good for testing | Slower – more approvals and registrations |

Inventory location | Overseas or bonded warehouse | Local warehouse / 3PL in mainland China |

Delivery times | Longer, especially from overseas | Faster, more competitive delivery |

Tax & duties | CBEC preferential policies in some categories/limits | Standard import duties plus local taxes |

Product categories | Best for selected categories and lower volumes | Better for high-volume and long-term expansion |

Typical platforms | Tmall Global, JD Worldwide, some cross-border Douyin stores | Tmall (domestic), JD.com, Pinduoduo, Taobao, local Douyin |

Best for | Market testing, niche/premium products, early-stage entry | Scaled operations, mass-market or long-term commitment |

The marketing of products over the Internet between two parties hosted in different countries is known as cross-border commerce or cross-border e-commerce (CBEC). In addition to the web platform, it includes payment gateways, logistics, marketing, and other processes.

You can choose to have the storage in the country of origin or have it in China, and based on that decision, you can do cross-border e-commerce or basic e-commerce

It must be taken into account that, unlike Tmall, not all e-commerce platforms in China offer the possibility of cross-border trade or internal trade (from China), so it may be a good option.

Step 3: Choosing the Right Chinese E-commerce Platform (Tmall, JD, Douyin & More)

There is not a single suitable e-commerce platform in China, but you have to use those that are most appropriate for the sector where you are, for your target audience, and for the changes and needs of the market.

There is not a single suitable e-commerce platform in China, but you must use those that are most appropriate for your sector.

However, here we mention in detail what the most effective e-Commerce platforms in China are for any company interested in penetrating the market, taking into account the corresponding adaptation that must be carried out after analyzing your market.

Tmall and Tmall Global: Key Platforms for Foreign Brands in China

Tmall, a leading B2C platform under the Alibaba Group, is one of the most trusted e-commerce marketplaces among Chinese consumers. Known for its high-quality product offerings and curated brand environment, Tmall is particularly favored by international brands looking to establish a strong presence in China. The platform offers a multi-category shopping experience, hosting a wide array of global and domestic brands across sectors like fashion, beauty, electronics, food, and lifestyle.

For foreign businesses entering the Chinese market, Tmall Global is often the preferred entry point. Designed specifically for cross-border commerce, it allows international brands to sell directly to Chinese consumers without a physical entity in China. This significantly reduces regulatory and operational hurdles while still providing access to Tmall’s vast customer base and robust logistics infrastructure through Alibaba’s Cainiao network.

On the other hand, brands with a more established presence or deeper understanding of the Chinese market may opt for Tmall Classic (Tmall Domestic). This version of the platform is tailored for companies registered within mainland China and offers greater integration with local systems, faster delivery options, and more extensive marketing tools within the Alibaba ecosystem.

Tmall offers two distinct pathways—Global and Classic—making it easier for both newcomers and established brands to succeed in China’s competitive e-commerce landscape.

Choosing between Tmall Global and Tmall Classic depends largely on the brand’s market readiness, operational capacity, and long-term China strategy.

Table: Tmall Global vs. Tmall Classic – A Complete Comparison

Aspect | Tmall Global | Tmall Classic (Domestic) |

Business registration | No legal entity required in China | Requires a locally registered company in China |

Seller type | Foreign brands selling from overseas | Domestic brands or foreign brands with local presence |

Logistics | Cross-border shipping via Cainiao network | Local warehousing and faster delivery |

Store interface language | Chinese for consumers; English support available for sellers | Entirely in Chinese |

Payment methods | RMB via Alipay with automatic currency conversion | RMB via Alipay and other local methods |

Operational costs | Platform fees + cross-border logistics | Platform fees + local operational costs |

Speed to market | Faster entry (no local entity needed) | Slower entry (requires local setup and licenses) |

Best suited for | Newcomers testing the market with limited local infrastructure | Established brands with local operations and long-term plans |

JD.com: A Trusted E-commerce Powerhouse for Premium Brands in China

JD.com (also known as Jingdong) is one of China’s largest and most reputable e-commerce platforms, known for its commitment to authentic products and fast, reliable delivery. Unlike marketplaces that rely heavily on third-party sellers, JD.com follows a hybrid model, combining direct sales with a curated third-party marketplace, giving brands more control over product presentation and logistics.

With a reputation for trust and efficiency, JD.com is the platform of choice for high-end brands entering China’s digital marketplace.

Particularly dominant in categories like consumer electronics, home appliances, and personal technology, JD.com is the go-to platform for brands aiming to launch premium and high-value products in China. The platform is especially appealing for foreign companies that prioritize quality assurance, brand integrity, and end-to-end supply chain control.

JD also offers JD Worldwide, its cross-border e-commerce solution, which allows international brands to sell directly to Chinese consumers without a local business license. With its own sophisticated logistics infrastructure (JD Logistics) and cutting-edge AI-driven retail technology, the company ensures fast shipping, even to lower-tier cities—an increasingly important segment in China’s online market growth.

In recent years, JD.com has expanded beyond electronics, building strong verticals in fashion, beauty, health, and grocery, further solidifying its position as an all-in-one e-commerce ecosystem.

Xiaohongshu (RED): The Rising Star of Social E-commerce in China

Xiaohongshu, also known as Little Red Book or RedNote, is one of the most influential platforms in China’s digital ecosystem—blending social media, content creation, and e-commerce into a seamless user experience. Originally launched as a space for users to share product reviews and lifestyle tips, Xiaohongshu has grown into a powerful social commerce platform, especially popular among young, urban consumers focused on beauty, fashion, wellness, and niche lifestyles.

What makes Xiaohongshu particularly unique is its trust-based content model, where users rely on authentic user-generated content (UGC). This has positioned the platform as a key player in xiaohongshu marketing, where storytelling, community-building, and soft-sell strategies outperform traditional advertising.

While many purchases are still completed on platforms like Tmall or JD.com, Xiaohongshu enables direct in-app purchases via shopping cart icons integrated into posts, creating a smooth journey from inspiration to transaction.

Brands working with xiaohongshu influencers gain access to highly engaged communities. For instance, L’Occitane collaborates with beauty creators to showcase skincare routines, tutorials, and reviews. These posts often include product links—either to Xiaohongshu’s mini-stores or external e-commerce platforms—turning influencer content into a direct sales channel.

With over 260 million monthly active users as of 2024, Xiaohongshu is no longer just a discovery platform—it’s a vital tool for any brand seeking to build long-term consumer trust and drive sales through xiaohongshu marketing strategies that prioritize authenticity and engagement.

Pinduoduo: Social Commerce and Group Buying at Scale in China

When talking about e-commerce in China, it’s impossible to overlook Pinduoduo, a platform that has rapidly grown to become one of the country’s top players—just behind Tmall and JD.com in terms of active user base. What sets Pinduoduo apart is its unique focus on social commerce and its innovative group purchasing model, where users are encouraged to team up with friends, family, or even strangers to get better deals on products.

This model is deeply rooted in a social shopping experience, where engagement and virality drive conversions. Through features that blend entertainment and shopping—such as mini-games, flash deals, and limited-time group discounts—Pinduoduo has built a massive following, especially in lower-tier cities and price-sensitive segments of the population.

Pinduoduo combines low prices with viral shopping experiences, making it China’s most successful social commerce platform.

Another distinctive feature is Pinduoduo’s Consumer-to-Manufacturer (C2M) model, which connects buyers directly with producers. This not only reduces supply chain inefficiencies but also enables extremely competitive pricing, tailored product development, and faster time-to-market. As a result, Pinduoduo has positioned itself as one of the most innovative platforms in China’s e-commerce landscape.

Users are drawn to Pinduoduo for its accessible prices, frequent discounts, and the added incentive of getting friends involved to unlock better deals. This makes it especially effective for brands looking to reach value-driven consumers and gain traction through viral, community-based marketing strategies.

Douyin: Short-Video E-commerce Driving Real-Time Conversions in China

As a central player in the fast-evolving world of ecommerce in China, Douyin—the Chinese version of TikTok—has transformed from a pure short-video app into a dynamic social commerce platform. Since launching its e-commerce capabilities in 2018, Douyin has redefined how Chinese consumers discover and purchase products, initially by partnering with platforms like Taobao and JD.com. Today, users can complete purchases directly within Douyin, thanks to its fully integrated e-commerce ecosystem.

In 2020, Douyin introduced native storefronts, allowing brands and retailers to establish online shops directly inside the app. This feature quickly gained traction among China’s younger, mobile-first consumers, who value speed, entertainment, and authenticity in their shopping experience. This evolution solidified Douyin social ecommerce as a seamless, content-driven ecosystem where consumers engage with and buy from brands in real time.

Combining video, influencers, and native shopping features, Douyin is at the forefront of ecommerce in China.

A key to success on the platform is collaboration with Douyin influencers, also known as KOLs (Key Opinion Leaders). These creators play a crucial role in Douyin marketing, building trust through engaging product reviews, tutorials, and live-stream sessions that drive high conversion rates. The Douyin influencer model is especially effective for brands aiming to increase both visibility and sales within the platform.

To further support brand growth, Douyin advertising offers powerful tools such as in-feed video ads, splash screen ads, and live commerce promotions, allowing brands to reach targeted audiences at scale. Combined with Douyin’s advanced analytics and real-time performance tracking, these advertising tools have become essential to any successful ecommerce in China strategy.

Douyin also provides dedicated support for merchants, including onboarding programs, campaign optimization tools, and access to consumer insights—helping brands fine-tune their content and selling approach in a competitive, fast-moving environment.

Typical Timeline to Launch E-commerce in China

Every project is different, but most brands follow a similar timeline from first discussions to going live:

Month 1–2: Research & strategy

Validate demand and competition, review regulations for your category, decide on cross-border vs domestic model, and define budget, KPIs and hero SKUs.Month 2–3: Partner selection & setup

Select a TP or e-commerce agency, choose your main platforms (e.g. Tmall Global + Douyin), and start account opening, contracts and documentation.Month 3–4: Store build & logistics

Design the store, localise content, confirm logistics and warehousing, test payment and order flows, and prepare customer service processes in Mandarin.Month 4–6: Soft launch & optimisation

Launch with a test budget, collaborate with a first batch of KOLs or live streams, analyse traffic and conversion data, and refine pricing, content and offers.

After this initial 4–6 month period, brands can decide whether to scale aggressively, optimise the current setup, or explore additional platforms such as Xiaohongshu or Pinduoduo.

Comparison of Leading E-commerce Platforms in China (Tmall, JD, Douyin, RED, Pinduoduo) E-commerce Platforms in China

With a vast and ever-evolving digital landscape, ecommerce in China is powered by several major platforms, each with unique strengths, user profiles, and marketing dynamics. For foreign brands, selecting the right platform is crucial to building an effective China marketing strategy and connecting with the right audience.

The following table provides a comparison of China’s top e-commerce platforms to help you assess which best suits your product, goals, and brand positioning:

Platform | Core Strength | User Profile | Sales Model | Best For | Marketing Approach |

Tmall (Classic & Global) | Premium brand image, strong trust | Middle to upper-class consumers | B2C, cross-border | Established brands, high-quality products | Search ads, platform promotions, KOLs |

JD.com | Fast delivery, high-quality electronics | Tech-savvy, price-sensitive shoppers | B2C, direct + third-party | Consumer electronics, household goods | JD ads, flash sales, festival campaigns |

Xiaohongshu (RED) | Authentic content + lifestyle influence | Young, female, urban Gen Z & Millennials | Content-driven + DTC | Beauty, fashion, wellness, niche brands | UGC, Xiaohongshu influencer campaigns |

Douyin | Viral short-video + impulse buying | Gen Z and Millennial mobile users | Live commerce + short video | Trendy products, FMCG, cosmetics, gadgets | Douyin influencer content + Douyin advertising |

Pinduoduo | Low prices + group buying gamification | Lower-tier city users, budget-focused | Social group purchasing (C2M) | Value products, agriculture, daily essentials | Group discounts, viral challenges, coupons |

Budget & Cost Overview for Selling Online in China

Foreign brands often underestimate the investment required to build a sustainable e-commerce presence in China. While exact costs depend on your category, platform and goals, it’s useful to think in three buckets:

1. Store setup & operations

Platform deposits and annual fees, store design, copywriting and localisation, customer service, and daily operations management (often run by a TP or e-commerce agency).2. Logistics & inventory

Product sourcing, packaging, international shipping or bonded warehouse fees, and local fulfilment. Cross-border models usually have lower fixed costs but higher shipping costs per unit.3. Marketing & traffic

Always plan a dedicated budget for traffic: platform ads, banner placements, KOL/KOC collaborations, live streaming, and content creation for Douyin or Xiaohongshu.

As a simple rule of thumb, many brands allocate at least as much to marketing and operations as to inventory in the first 6–12 months. Treat it as a market test period to understand your unit economics and refine your positioning before scaling.

Cost Bucket | What It Includes | Example Share of Total Budget* |

Inventory & packaging | Product manufacturing, packaging, export preparation | 25–40% |

Platform & operations | Platform fees, store design, TP/ops management, customer care | 20–30% |

Logistics & warehousing | International shipping, bonded/local warehouse, fulfilment | 15–25% |

Marketing & traffic | Ads, KOL/KOC fees, live streaming, content creation | 25–40% |

Contingency | Unexpected costs, extra promos, optimisation tests | 5–10% |

Find a TP (Tmall Partner) or E-commerce Agency in China

The final—and often most critical—step to successfully entering the ecommerce in China landscape is partnering with a Tmall Partner (TP) or experienced China e-commerce agency. These local experts manage everything needed to establish and grow your brand in the Chinese market. A prime example is InfluChina, a trusted agency specializing in helping foreign brands navigate and succeed in China’s complex digital environment.

A Tmall Partner or e-commerce agency typically offers a comprehensive range of services, including:

- Market and competitor analysis: Understanding what works in your category, evaluating industry trends, and analyzing the strategies of top competitors.

- Branding and marketing strategy: Agencies like InfluChina help tailor a China marketing strategy aligned with your brand identity, product positioning, and target audience.

- Store setup: From launching your official store to uploading product catalogs and crafting localized product descriptions, everything is handled.

- Operational and logistics management: This includes inventory management, order fulfillment, product updates, and monthly performance reporting.

- Customer service: Ensuring fast, localized, and culturally relevant customer support in Mandarin.

- Marketing campaign execution: Managing key sales events like Double 11 (Singles’ Day), coordinating promotions across social platforms, running in-platform advertising, and synchronizing campaigns for maximum impact.

By working with a professional Tmall Global Partner or agency such as InfluChina, brands gain a reliable local team that understands the nuances of ecommerce in China—from platform algorithms to consumer behavior—and can build an effective marketing in China approach from the ground up.

If you’re looking to effectively enter the Chinese e-commerce market, don’t hesitate to contact InfluChina and discover how the right partner can open the door to long-term success in one of the world’s most dynamic online marketplaces.

InfluChina: Your Gateway to the China E-commerce Market

Driving Sales With Chinese E-commerce Apps & KOLs

To maximize your impact in the China ecommerce market, consider these strategies:

Influencer Collaboration

Partnering with Chinese influencers, known as Key Opinion Leaders (KOLs), can dramatically boost your brand’s visibility and credibility.

Multichannel Strategy

Embrace a multichannel approach by establishing a presence on major Chinese e-commerce apps and social media platforms to enhance brand loyalty and consumer engagement.

Localize Your Brand

A fundamental step in any effective China marketing strategy is localizing your brand—not just in language, but in how it connects with the values, habits, and expectations of Chinese consumers. This process is essential to build credibility, relevance, and emotional connection in one of the world’s most competitive digital markets.

Key aspects to consider when localizing your brand for marketing in China include:

- Adapted communication style: Your tone of voice, storytelling, and visual content should reflect Chinese cultural norms and consumer psychology. From the way you present your brand values to how you interact on social platforms, communication must feel natural and culturally relevant to your target audience.

- Chinese brand name: Creating a localized name is crucial. It’s not only about phonetic similarity but also choosing characters with positive meanings and avoiding any unintended connotations. A strong Chinese name enhances recognition and consumer trust.

- Culturally aligned visuals and symbols: Review your logo, color palette, icons, and brand imagery to ensure they resonate with Chinese aesthetics and do not conflict with cultural sensitivities. Even minor visual adjustments can significantly improve brand perception.

By aligning your brand with local expectations while maintaining your identity, you can position yourself for long-term success in ecommerce in China and stand out in a highly competitive landscape.

FAQ

FAQs About Ecommerce in China

What is the best ecommerce platform in China?

There is no single “best” platform for every brand. Tmall and JD.com are ideal for established or premium brands that want a strong flagship presence. Tmall Global and JD Worldwide are usually better for cross-border testing, while Douyin and Xiaohongshu (RED) are powerful for social commerce and influencer-driven sales. The best choice depends on your category, budget, and how ready you are to invest in branding vs short-term sales.

How much does it cost to open an online store in China?

Costs vary widely by platform and business model. You should consider: platform deposits and annual fees, store design and content localisation, warehousing and logistics (cross-border vs local), plus marketing and influencer budget. A basic cross-border test store typically requires a five-figure USD investment, while a full flagship store on Tmall or JD often needs a larger, long-term budget.

What defines ecommerce in China?

E-commerce in China is more than just online shopping. It combines marketplaces (Tmall, JD, Pinduoduo), social platforms (Douyin, Xiaohongshu, WeChat), live streaming and mobile payments (Alipay, WeChat Pay) into a highly integrated ecosystem. Consumers discover, evaluate and purchase products in one continuous journey, often within the same app.

What advantages does ecommerce offer over traditional commerce?

Compared with traditional retail, e-commerce in China offers access to a national customer base, lower entry barriers than opening physical stores, real-time data on traffic and conversion, and flexible pricing and promotion testing. For international brands, it is often the fastest way to build awareness and generate sales without immediately investing in an offline network.

What is cross-border e-commerce in China?

Cross-border e-commerce allows foreign brands to sell to Chinese consumers from overseas or bonded warehouses, without establishing a full legal entity in mainland China. Platforms like Tmall Global, JD Worldwide and some Douyin stores support this model. It can simplify compliance and speed up market entry, although there are still category-specific regulations and taxes to consider.

Do I need a Chinese company to start selling online in China?

Not always. With cross-border e-commerce platforms such as Tmall Global or JD Worldwide, you can sell into China using an overseas entity, as long as you meet their eligibility requirements. However, if you want to open a domestic store (for example Tmall Classic), use local payment gateways directly or store goods inside mainland China at scale, you will usually need a Chinese legal entity or a local partner.

How long does it take to launch a China e-commerce store?

Timelines depend on your readiness and platform choice. If your products, branding and logistics are prepared, a cross-border test store may go live within a few months. Domestic flagship stores and larger multi-platform setups typically take longer, especially if you still need to handle company registration, product registration and localisation.

Why should I work with a TP or Chinese e-commerce agency?

The China e-commerce environment is complex and fast-moving. A TP or specialised agency helps you navigate platform rules and approvals, manage day-to-day store operations, logistics and customer service, plan campaigns around key shopping festivals (such as 6.18 and 11.11), and coordinate KOL/KOC activities. This lets your internal team focus on brand and product while a local partner executes on the ground.