TL;DR | Luxury Influencer Marketing in China

China’s luxury market is evolving rapidly, driven by digital natives who value authenticity, exclusivity, and storytelling. To succeed, luxury brands must localize their strategy — combining KOL authority with KOC authenticity across key platforms like Xiaohongshu, Douyin, and WeChat.

True success comes from balancing global prestige with local resonance — investing in long-term influencer relationships, using data-driven targeting, and working with specialized China marketing agencies that understand both luxury culture and Chinese social ecosystems.

Done right, luxury influencer marketing in China builds not only awareness, but also trust, desirability, and long-term brand equity.

China remains a key driver of global luxury consumption, representing a dynamic and highly digitalized market where high-end brands compete fiercely for attention. In recent years, the shift from overseas shopping to domestic consumption has reshaped the industry: while in 2015 over 75% of Chinese luxury purchases occurred abroad, today most of them take place within China’s borders. In 2023 alone, nearly 280 new luxury stores opened across the country, and platforms like WeChat, Douyin (TikTok), and Xiaohongshu (RED) emerged among the top 10 online channels for luxury retail.

With this shift came a surge in Luxury Influencer Marketing in China. As brick-and-mortar dominance gives way to online engagement, short videos, live commerce, and influencer-driven storytelling have become key tools for luxury brands to connect with local consumers. Categories like luxury jewelry, cosmetics, and fashion continue to thrive, especially when endorsed by trusted Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs) on popular platforms.

This article explores the evolution of luxury influencer marketing in China—why it matters, how it works, and what brands need to know to succeed in one of the world’s most competitive and sophisticated luxury markets.

1. China’s Booming Luxury Market: Key Data & Growth Insights

Over the past decade, China has emerged as a global powerhouse in luxury consumption, offering unmatched opportunities for brands looking to expand their influence. According to Bain & Company, China accounted for 15% of the global personal luxury goods market in 2022, with that share expected to reach 16% by 2023. This growth is fueled by rising disposable income, digital-savvy consumers, and a strong appetite for premium, self-expressive products.

Despite global economic uncertainty, the luxury market in China has shown impressive resilience. In 2023, domestic luxury spending hit 607.7 billion yuan, representing an 11% year-over-year increase. Since 2020, domestic luxury consumption has consistently surpassed overseas spending, reflecting a significant shift in consumer behavior and loyalty toward local luxury retail experiences.

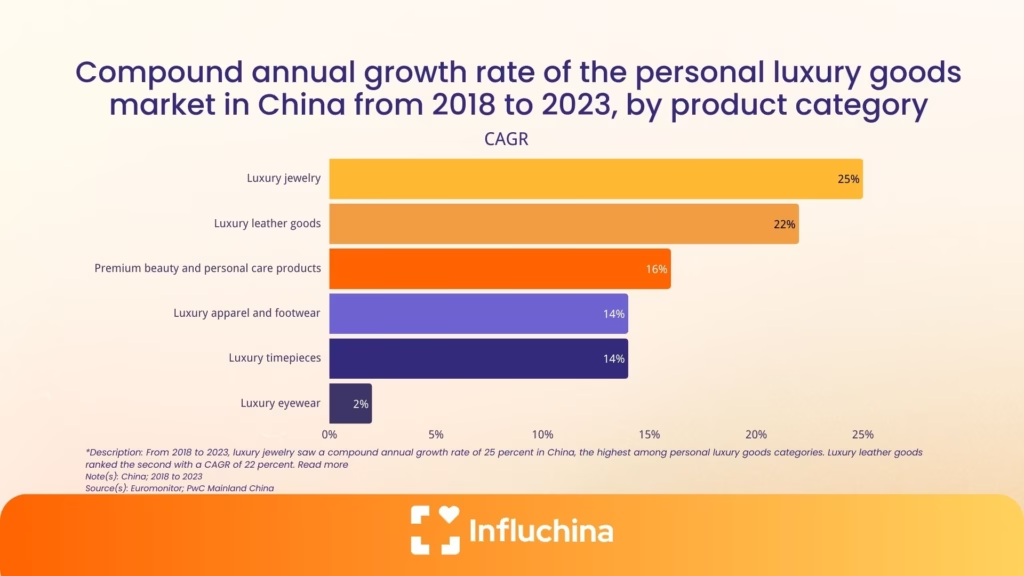

The future looks even brighter. Forecasts suggest that China’s personal luxury goods market will reach USD 148 billion by 2030, more than doubling from USD 61 billion in 2022. Categories such as luxury jewelry and leather goods have seen the fastest growth, with compound annual growth rates of 25% and 22% respectively, underscoring the strong demand for high-end accessories and status-driven purchases.

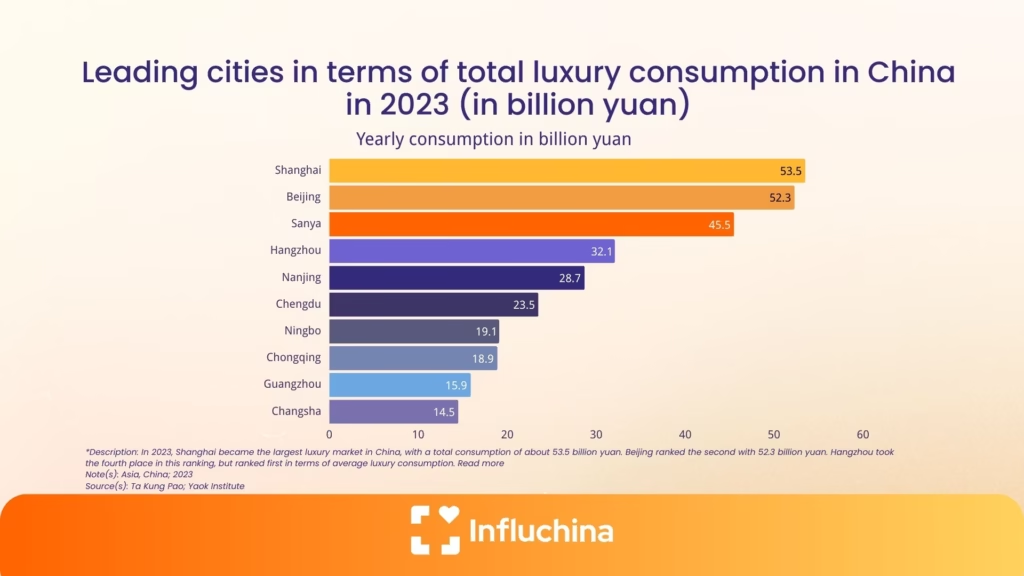

Cities like Shanghai, Beijing, and Sanya lead China’s luxury market not only in cultural relevance but also in total spending. According to Statista and the Yaok Institute, Shanghai ranked first in 2023 with 53.5 billion yuan in luxury consumption, followed closely by Beijing (52.3 billion yuan) and Sanya (45.5 billion yuan). Other high-ranking cities include Hangzhou (32.1 billion yuan) and Nanjing (28.7 billion yuan).

As younger generations enter the luxury market earlier than ever—most before the age of 30—and as consumers increasingly favor local shopping experiences, China has become more than just a profitable market. It’s a strategic battleground for global luxury brands, where influencer marketing plays a key role in building relevance, trust, and long-term brand equity.

2. How Chinese Consumers Shop for Luxury Online

Luxury consumers in China are among the most digitally engaged in the world, reshaping how premium brands connect with their audiences. Unlike traditional luxury buyers who rely primarily on in-store experiences, Chinese consumers are leading a shift toward content-rich, digitally integrated shopping journeys. This transformation includes everything from influencer reviews and short videos to live commerce and storytelling across Chinese social media platforms.

For brands investing in luxury influencer marketing in China, understanding these digital behaviors is essential. Success depends on more than just visibility—it requires a deep connection with how luxury is discovered, shared, and experienced in China’s fast-moving online landscape. Crafting the right digital experience is now a core part of any effective luxury marketing strategy in China.

2.1 Online Channels Dominate Brand Discovery

According to a 2023 survey by Tencent, 58% of luxury consumers in China discover brands through online channels, such as official brand websites, WeChat accounts, and mini-programs. These digital touchpoints are now more influential than traditional offline activities like VIP events or fashion shows.

Moreover, platforms like Xiaohongshu (RED), Douyin (TikTok China), and Weibo have become essential in shaping perceptions, offering users visual-first experiences, KOL reviews, and lifestyle content that inspires aspirational purchases.

2.2 Influencer Content Drives Engagement and Trust

Influencers—especially Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs)—play a central role in luxury marketing. Around 33% of consumers reported that celebrity or influencer content sparked their interest in luxury products. These digital tastemakers bridge the gap between exclusivity and accessibility, offering followers a more relatable entry point into high-end brands. Incorporating influencers into a well-designed China marketing strategy allows luxury brands to engage local audiences with authenticity and cultural relevance.

2.3 Localized, Interactive Content Performs Best

What draws attention in China is not just the brand, but how the message is delivered. Content that is localized, interactive, and visually aligned with the user’s aesthetic preferences outperforms generic ads. Over 38% of luxury consumers said that strong fashion aesthetics and personal style alignment were the most appealing aspects of a luxury campaign.

This highlights the importance of creating campaigns that feel native to the platform, incorporate Chinese cultural elements, and deliver authentic narratives, especially through short videos and mobile-first formats.

3. Understanding Luxury Influencer Marketing in China

In China, luxury influencer marketing has become one of the most powerful tools for high-end brands to connect with consumers in a culturally relevant and emotionally engaging way. It goes far beyond product placement: it’s about storytelling, building trust, and translating global prestige into local desire.

In a market where digital engagement drives almost every stage of the buying journey, influencers—both large and small—play a central role in how luxury brands are discovered, perceived, and consumed.

3.1 From Global Prestige to Local Influence

While luxury brands often carry global recognition, success in China depends on local relevance. Chinese consumers are highly sophisticated, digitally savvy, and expect personalized, relatable content. Influencer marketing helps brands bridge the cultural gap, presenting their values, heritage, and aesthetics through voices that local audiences trust.

Rather than focusing on hard selling, luxury influencer marketing is about building brand narratives that reflect elegance, aspiration, and authenticity in a Chinese context.

3.2 The Influencer Ecosystem: Reach Meets Relevance

One of the unique features of luxury influencer marketing in China is the diversity of profiles involved. Unlike traditional celebrity-driven marketing, Chinese campaigns often blend multiple layers of influence—from high-profile personalities to relatable consumer voices—to engage different segments of the audience.

Rather than focusing solely on reach, luxury brands value influencers who bring cultural insight, authenticity, and emotional connection. Whether it’s a well-known fashion figure attending a runway show or a lifestyle micro-influencer sharing a personal product review, both can play essential roles in building brand credibility and desire.

This layered approach reflects the strength of China’s digital culture, where trust and social proof often matter as much as visibility.

4. Top Chinese Platforms for Luxury Brand Marketing (Douyin, Xiaohongshu, WeChat)

Luxury influencer marketing in China thrives on platforms that blend content, commerce, and community. Unlike Western markets where one or two apps dominate, China’s digital ecosystem is diverse and platform-specific—each offering unique formats, audiences, and advantages for luxury brands.

Here’s a breakdown of the four most important platforms and how they are used effectively in the luxury space:

4.1 WeChat: For Storytelling, Loyalty, and VIP Engagement

WeChat is much more than a messaging app—it’s a closed-loop digital universe. For luxury brands, it serves as a hub for:

- Long-form content: In-depth articles, lookbooks, and campaign breakdowns

- Private communication: VIP services and personal shoppers via official accounts or groups

- Mini-programs: Integrated stores, livestreams, and virtual showrooms within the app

Example: Louis Vuitton uses WeChat mini-programs for product drops and styling content. Cartier often sends exclusive WeChat invitations to private viewings or offline events.

In addition to content and commerce, WeChat advertising allows brands to amplify their campaigns through targeted placements, reaching high-value users based on interests, location, and behavior.

WeChat is ideal for brands aiming to build long-term loyalty and maintain deeper relationships with high-value clients.

4.2 Xiaohongshu (RedNote): For Authentic Reviews and Aspirational Lifestyle

Xiaohongshu, also known as RedNote, is where aesthetic meets authenticity. It’s a favorite among Gen Z and Millennial women looking for:

- Product reviews and comparisons

- Outfit inspiration, unboxings, and “what’s in my bag” posts

- Personal luxury experiences: spa visits, hotel stays, first purchases

Example: Chanel was the most mentioned brand by KOLs on Xiaohongshu in 2023, with over 376,000 posts—proving how strong its lifestyle positioning is on the platform.

As one of the most effective channels for Xiaohongshu marketing, RedNote is the go-to for luxury brands wanting to spark discovery and build trust through peer-driven content.

4.3 Douyin: For High-Impact Visual Campaigns and Live Commerce

Douyin, the Chinese version of TikTok, is where luxury meets performance. With its short-video format, it’s ideal for:

- Visually bold brand storytelling

- Real-time influencer content: events, product demos, styling

- Livestream shopping, especially for limited-edition launches

Example: Ralph Lauren became the most successful luxury brand on Douyin in early 2025, ranking #1 on the platform’s brand index.

Partnering with the right Douyin influencer can elevate campaign performance, amplify brand storytelling, and drive high engagement. If the goal is massive reach and conversion-ready content, Douyin is essential.

4.4 Weibo: For Visibility, Buzz, and Celebrity Power

Weibo functions like a hybrid between Twitter and Instagram, making it powerful for:

- Major announcements and campaign launches

- Celebrity collaborations and hashtag challenges

- Viral brand moments and social trends

Example: Luxury brands like Dior, YSL, and Gucci often use Weibo for brand ambassador promotions and event coverage, leveraging their celebrities’ massive fanbases.

Weibo offers instant visibility and is great for driving large-scale conversations, especially during campaign peaks.

Together, these platforms allow luxury brands to reach, engage, and convert their audiences at multiple touchpoints in China’s unique digital landscape. The most effective influencer strategies combine them strategically—tailoring content to the strengths of each.

Luxury Platform Comparison Table

Platform | Best For | Audience Type | Example Luxury Use Case |

VIP loyalty, storytelling | Mature consumers | Dior VIP Mini-Program campaigns | |

Xiaohongshu (RED) | Authentic reviews, lifestyle storytelling | Gen Z, millennial women | Chanel product diaries & user UGC |

Douyin | High-impact videos, livestream commerce | Younger mass audience | Ralph Lauren short-video series |

Celebrity collaborations, trending topics | Nationwide | YSL ambassador events coverage |

Source: InfluChina Luxury Marketing Insights, 2025.

5. KOLs, KOCs & Celebrities: Who Drives Luxury Influence in China

In China’s luxury market, not all influencers serve the same purpose. Successful campaigns often rely on a mix of profiles to build both reach and trust. From celebrity ambassadors to relatable micro-influencers, each type plays a distinct role in the customer journey—from brand awareness to final purchase.

If you’re exploring how to design or improve your brand’s strategy, our ebook on influencer marketing in China provides a deeper look into the most effective influencer profiles and how luxury brands are leveraging them across different platforms.

Let’s explore the key influencer types and how luxury brands put them to work.

5.1 Celebrity KOLs: The Faces of Prestige

Celebrities and high-profile artists remain a cornerstone of luxury campaigns in China. Brands carefully select them based on public image, style, and ability to generate massive exposure on platforms like Weibo and Douyin. These ambassadors play a key role in shaping the aspirational image of the brand and attracting large audiences.

According to data from EnData, several major luxury brands invested heavily in celebrity partnerships between May 2023 and April 2024:

This reflects how crucial celebrity collaborations are in the Chinese luxury market, especially when supported by strong storytelling and multi-platform exposure.

At the same time, young talents and idol artists are particularly in demand. A large share of brand endorsers belong to the pop culture scene, showing the strong emotional connection between youth culture and luxury branding in China.

5.2 Fashion and Lifestyle KOLs: Style with Influence

Not all luxury influencers are celebrities—many of the most effective voices come from the fashion, beauty, and lifestyle worlds, where they’ve built strong connections with trend-sensitive audiences. These KOLs are trusted for their taste, style, and ability to translate luxury into aspirational, everyday content.

Fashion and lifestyle influencers are especially valuable for:

- Launching new collections with visual storytelling

- Creating brand buzz around pop-ups, runway shows, and private events

- Producing aesthetically refined content that fits luxury values

They dominate platforms like Xiaohongshu (RedNote) and Weibo, where followers look for product inspiration, styling tips, and luxury lifestyle snapshots.

In 2023, Chanel led the rankings on Xiaohongshu in terms of influencer engagement, with significantly more KOL-generated content than other brands. Here’s a look at the top performers:

These numbers show how deeply embedded these brands are in the digital luxury conversation. Working with the right KOLs allows brands not only to showcase products, but also to shape how they are perceived—and desired—by China’s digitally native consumers.

5.3 KOCs (Key Opinion Consumers): Relatable and Trusted

While they may not have massive followings, KOCs (Key Opinion Consumers) play a vital role in luxury marketing strategies in China. These are everyday consumers who share authentic, personal experiences—making their content feel more like a trusted recommendation than a paid promotion.

Their influence lies in credibility, relatability, and peer-level trust, which is especially powerful when it comes to high-involvement purchases like luxury goods.

According to a 2023 consumer survey, one in three luxury shoppers (33%) said that influencer or celebrity product try-ons sparked their interest in a brand. This shows that real, experience-driven content often has more persuasive power than traditional ads.

KOCs are especially effective on platforms like Xiaohongshu, where users value unfiltered reviews, day-in-the-life posts, and realistic portrayals of how luxury items fit into daily life. Collaborating with a trusted Xiaohongshu influencer allows brands to connect with consumers on a more personal level. For many brands, working with KOCs helps close the gap between aspiration and action—translating inspiration into conversion.

5.4 Niche Influencers: Experts with Authority

In the world of luxury marketing, not all influence is built on popularity—credibility and expertise are equally powerful. That’s where niche influencers come in. These are individuals with deep knowledge and authority in specific high-end sectors such as fine jewelry, luxury watches, gourmet cuisine, high fashion design, art, or vintage collectibles.

Their audiences may be smaller, but they are highly targeted, loyal, and often affluent, making niche influencers particularly effective for luxury brands looking to build trust around high-value or heritage-rich products.

As part of a broader digital marketing in China strategy, partnering with these expert voices allows luxury brands to reach not just more people—but the right people, with messaging that speaks to precision, quality, and cultural sophistication.

5.5 Strategic Mix: Layered Influence for Maximum Impact

The most successful luxury brands combine these influencer types strategically:

- Celebrities build brand prestige and awareness

- KOLs drive aesthetic appeal and lifestyle association

- KOCs provide social proof and purchase motivation

- Niche experts support credibility for specific categories

The following table compares different types of influencers in China’s luxury market, highlighting their roles, main platforms, and ideal campaign uses.

Comparison of Influencer Types in Luxury Marketing in China

| Influencer Type | Main Role | Key Platform(s) | Best For |

|---|---|---|---|

| Celebrities | Build prestige and mass awareness | Weibo, Douyin | Brand launches, event promotion, luxury positioning |

| KOLs | Create aesthetic lifestyle associations | Xiaohongshu, Weibo | Storytelling, trend influence, collection showcases |

| KOCs | Provide trust through relatable recommendations | Xiaohongshu | Product reviews, day-in-the-life content, driving conversions |

| Niche Experts | Add credibility in specialized luxury sectors | WeChat, RED, livestream platforms | Jewelry, watches, art, and high-value category validation |

Together, they help luxury brands in China reach a wide audience while maintaining depth, trust, and cultural relevance.

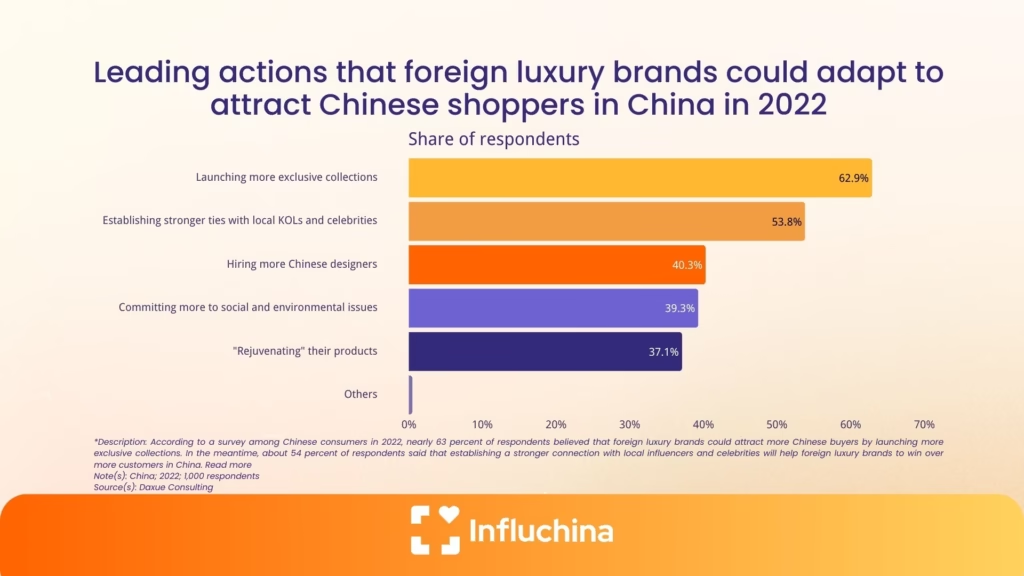

As influencer marketing becomes more central to luxury brand strategies in China, consumer expectations are evolving as well. According to a 2022 survey, over half of Chinese shoppers (53.8%) believe that foreign luxury brands should establish stronger ties with local KOLs and celebrities to better resonate with the local market. This was the second most important action identified—only behind launching more exclusive collections.

6. Winning Strategies for Luxury Influencer Marketing in China

In China’s dynamic digital landscape, successful luxury influencer campaigns are more than collaborations—they are carefully crafted cultural strategies. To build relevance and generate results, brands must go beyond visibility and focus on authenticity, exclusivity, and local resonance.

This process often begins with thorough market research in China, helping brands understand local consumer behaviors, platform dynamics, and influencer credibility before launching campaigns.

Here are the key strategies that leading luxury brands use to make influencer marketing work in China.

6.1 Co-Create Exclusive and Localized Experiences

Chinese luxury consumers are highly attracted to exclusivity. According to a 2022 survey, 62.9% of respondents said that launching more exclusive collections is the top action foreign luxury brands can take to attract them【Image†source】.

Influencer campaigns that offer limited-edition drops, behind-the-scenes access, or VIP-only events not only align with this desire for exclusivity but also create strong content opportunities for KOLs and celebrities.

Example: Louis Vuitton’s pop-ups in Shanghai often invite fashion KOLs for first-look experiences, which they share with followers via WeChat, RED, and Douyin.

6.2 Build Long-Term Partnerships with Trusted Influencers

One-off influencer posts are no longer enough. Successful luxury brands invest in long-term relationships with a curated group of KOLs and KOCs who truly reflect the brand’s identity and values.

These ambassadors grow with the brand, allowing for a more natural and consistent brand narrative over time.

In the same survey, 53.8% of Chinese consumers said stronger ties with local KOLs and celebrities would make brands more appealing—showing that relationship-building is a strategic advantage.

6.3 Leverage Platform Strengths Strategically

Each platform plays a different role, and luxury brands must tailor their content accordingly:

- Use RED for authentic reviews and lifestyle inspiration

- Use Douyin for high-impact, short-form visual campaigns

- Use WeChat for deep storytelling and VIP loyalty

- Use Weibo for mass exposure and celebrity buzz

Brands that distribute a consistent message across platforms—but in the right format—are far more likely to see impact. Partnering with an experienced social media agency in China can help brands navigate this complex ecosystem and optimize content strategies for each platform’s unique strengths.

6.4 Highlight Heritage with a Modern Twist

While luxury heritage is important, it must be communicated in a way that feels fresh, relevant, and engaging to younger consumers.

Campaigns that incorporate Chinese cultural references, youth language, or social values like sustainability are more likely to resonate.

Understanding and adapting to China marketing trends is essential. For example, brands like Gucci and Dior have worked with Chinese artists, designers, or influencers to reframe their European identity in a local and creative way—bridging the gap between tradition and innovation in a way that speaks directly to the modern Chinese audience.

6.5 Combine Aspirational and Relatable Voices

As explored earlier, the ideal influencer mix includes KOLs for aspiration and KOCs for credibility. Campaigns that integrate both can maximize reach while driving purchase decisions.

This dual approach reflects the essence of KOL marketing in China, ensuring luxury brands remain both inspiring and trustworthy—two pillars of influence that Chinese consumers value highly.

7. Regional Insights: Where China’s Luxury Influence Is Strongest

While luxury demand in China is nationwide, understanding regional dynamics can dramatically improve campaign performance. Chinese luxury consumers differ across city tiers — in tastes, social platform preferences, and motivations.

Tier 1 Cities (Beijing, Shanghai, Shenzhen):

Home to China’s elite and high-net-worth individuals, these cities remain the cornerstone for flagship campaigns, store openings, and celebrity collaborations. Prestige and limited-edition exclusivity work best here.

Tier 2 Cities (Chengdu, Hangzhou, Wuhan, Chongqing):

These rising hubs are digital powerhouses — younger, more experimental, and highly active on Douyin and Xiaohongshu. They respond strongly to authentic storytelling and lifestyle-driven content from relatable influencers.

Tourism & Resort Destinations (Sanya, Hainan, Macau):

Rapidly growing as luxury tourism centers, these locations are ideal for brand experiences, pop-up events, and travel collaborations featuring influencers who capture aspirational moments.

Key takeaway: Luxury influence in China is no longer confined to Shanghai or Beijing. A geographically nuanced strategy — aligning content tone, influencer type, and platform mix with regional behavior — is essential to maximize reach and relevance.

8. Common Mistakes Global Luxury Brands Make in China (and How to Avoid Them)

While luxury influencer marketing in China offers enormous potential, it also comes with unique challenges that global brands must navigate carefully. From cultural nuances to platform complexity, success depends not only on strategy—but also on adaptability, local understanding, and precision execution.

Here are some of the most common challenges—and how to overcome them:

8.1 Difficulty Accessing and Negotiating with Top Luxury Influencers

One of the most overlooked challenges in luxury influencer marketing is the limited direct access to influencers, especially in China. Many luxury KOLs and celebrities are represented by exclusive talent agencies, which act as gatekeepers and manage all communication, pricing, and campaign approvals.

For foreign brands unfamiliar with this system, contacting and negotiating with the right influencer can be slow, expensive, and opaque.

How to overcome it:

- Work with local agencies that already have established relationships and negotiation experience with luxury influencers

- Ensure there is a clear understanding of market rates, deliverables, and expected engagement

Prioritize agencies that can provide strategic guidance and execution, not just contact lists

Influchina, for example, works directly with many of China’s top fashion and lifestyle KOLs, helping brands streamline collaboration, negotiate fair terms, and ensure content aligns with both brand identity and influencer style.

Having the right local partner can be the difference between an influencer simply posting a campaign—and becoming a true brand advocate.

8.2 Misalignment Between Brand Image and Influencer Voice

One of the biggest risks in influencer marketing is choosing a partner whose tone, values, or audience do not align with the brand. In the luxury space, this disconnect can damage prestige and consumer trust—especially when working with Chinese social media influencers, whose voice and style must reflect both the platform’s culture and the brand’s identity.

How to overcome it:

- Conduct in-depth screening and vetting before collaborating

- Focus on value alignment and long-term fit, not just follower count

Involve local teams or agencies who understand cultural sensitivities and aesthetic expectations

8.3 Navigating Platform Fragmentation and Constant Change

China’s digital ecosystem is highly fragmented and evolves rapidly. Algorithms shift, formats update, and new platforms emerge constantly.

How to overcome it:

- Tailor content and format specifically to each platform

- Maintain flexibility and test new content types or platform features

- Work with local partners who stay on top of tech trends and user behavior

8.4 Overcommercialization and Audience Fatigue

Consumers—especially Gen Z—are increasingly wary of content that feels too promotional or insincere. Overuse of hard-sell tactics can lead to disengagement and skepticism.

How to overcome it:

- Prioritize authentic storytelling and experience-led content

- Empower influencers to speak in their own voice

- Mix brand heritage and emotional connection with product messaging

8.5 Compliance, Contracts, and Usage Rights

Legal and operational challenges can emerge, especially when handling contracts, payment, and rights across jurisdictions.

How to overcome it:

- Use clear, bilingual contracts with detailed usage terms and content guidelines

- Ensure legal compliance with Chinese regulations on advertising and KOL promotions

Clarify ownership and timelines for repurposing influencer content

8. The Future of Luxury Marketing in China: Beyond 2025

As China continues to lead global luxury consumption, influencer marketing is no longer just an option—it’s a strategic necessity. The most successful brands are those that understand how to blend global prestige with local storytelling, leveraging the power of KOLs, KOCs, and platform-specific content to build trust and desire.

From platforms like Xiaohongshu and Douyin to long-term partnerships with authentic voices, luxury influencer marketing in China requires a thoughtful, culturally sensitive approach. Consumers are demanding not only exclusivity and quality—but also relevance, transparency, and emotional connection.

Yet navigating this landscape can be challenging—especially when dealing with influencer access, evolving platform trends, and audience expectations. That’s why working with a reliable China influencer agency that understands the market is essential.

Influchina offers direct access to top-tier luxury influencers, helping brands negotiate effectively, create culturally aligned campaigns, and achieve real impact in China’s unique digital ecosystem.

Luxury Influencer Marketing in China isn’t just about being seen—it’s about being remembered and respected. For brands ready to elevate their presence in the world’s most competitive luxury market, the time to act is now.

Key Takeaways:

70% of luxury sales now happen domestically in China.

Xiaohongshu and Douyin lead for luxury discovery and conversion.

KOLs build aspiration; KOCs drive purchase trust.

Localization and long-term partnerships deliver sustained brand equity.

Agencies with local expertise (like InfluChina) simplify execution and compliance.

FAQ

Frequently Asked Questions (FAQs) about Luxury Influencer Marketing in China

What makes China’s luxury market unique?

China’s luxury consumers are young, digital-first, and value both brand heritage and local relevance. Unlike Western audiences, they seek emotional storytelling, exclusivity, and authentic influencer validation before purchasing.

What is luxury influencer marketing in China?

Luxury influencer marketing in China involves collaborations between high-end brands and influential individuals—such as celebrities, Key Opinion Leaders (KOLs), and Key Opinion Consumers (KOCs)—to promote products and enhance brand image. These influencers leverage platforms like WeChat, Xiaohongshu (RED), Douyin, and Weibo to reach and engage with target audiences. The strategy focuses on storytelling, authenticity, and cultural relevance to resonate with Chinese consumers.

Why is influencer marketing essential for luxury brands in China?

Chinese consumers are among the most digitally engaged globally, with a strong presence on social media platforms. They value peer recommendations and authentic content over traditional advertising. Influencer marketing allows luxury brands to build trust, drive engagement, and influence purchasing decisions effectively within this digital ecosystem.

How do luxury brands select the right influencers in China?

Selecting the right influencer involves assessing factors such as audience demographics, engagement rates, content quality, and alignment with brand values. Brands often collaborate with agencies like Influchina, which have established relationships with top-tier influencers and can facilitate partnerships that align with strategic objectives.

How can luxury brands measure influencer ROI in China?

Track performance through:

Engagement rate (likes, comments, saves)

Brand mentions and hashtag reach

UGC volume (“notes” or posts created by users)

Conversion data from in-app stores or Mini-Programs

A strong agency partner can provide real-time analytics dashboards.

What are the key platforms for luxury influencer marketing in China?

The primary platforms include:

- WeChat: Ideal for in-depth storytelling, customer relationship management, and exclusive content through mini-programs.

- Xiaohongshu (RED): Focuses on lifestyle content, product reviews, and community engagement, particularly among young female consumers.

- Douyin: China’s version of TikTok, suitable for short-form videos, live streaming, and viral marketing campaigns.

- Weibo: A microblogging platform effective for mass communication, celebrity endorsements, and trending topics.

Which social media platforms are most effective for luxury marketing in China?

The top platforms are Xiaohongshu (RED) for lifestyle inspiration, Douyin for short-video storytelling, WeChat for CRM and VIP engagement, and Weibo for celebrity amplification. Each plays a different role in the luxury funnel.

What challenges do luxury brands face in influencer marketing in China?

Challenges include navigating a complex digital landscape, ensuring cultural relevance, managing influencer relationships, and measuring return on investment (ROI). Working with experienced local partners can help mitigate these challenges by providing insights and facilitating effective campaign execution.

How can luxury brands measure the success of influencer campaigns in China?

Success can be measured through various metrics, including engagement rates (likes, comments, shares), follower growth, website traffic, conversion rates, and sales figures. Advanced analytics tools and collaboration with knowledgeable agencies can provide deeper insights into campaign performance.

What is the role of KOLs and KOCs in luxury marketing?

KOLs (Key Opinion Leaders) are influencers with substantial followings and are often used for brand awareness and prestige. KOCs (Key Opinion Consumers) have smaller, more niche audiences and are perceived as more relatable, making them effective for driving trust and conversions. A balanced strategy incorporating both can maximize reach and impact.

How should luxury brands choose KOLs or KOCs?

Select influencers whose persona matches the brand’s prestige level.

Use KOLs (Key Opinion Leaders) for high-end collaborations and visibility.

Combine with KOCs (Key Opinion Consumers) for peer-driven authenticity.

Vet each influencer’s engagement quality and follower demographics before collaboration.

What type of content works best for luxury audiences?

Content that blends visual storytelling, craftsmanship, and aspiration performs best.

Examples include behind-the-scenes videos, product origin stories, and influencer diaries that highlight how luxury enhances daily lifestyle moments.

How important is localization in influencer marketing strategies?

Localization is crucial. Content must resonate with Chinese cultural values, language nuances, and consumer behaviors. Tailoring campaigns to local preferences enhances authenticity and effectiveness, fostering stronger connections with the target audience.

Can luxury brands manage influencer campaigns without local partners?

While possible, managing campaigns without local expertise can be challenging due to cultural differences, language barriers, and unfamiliarity with the digital landscape. Partnering with local agencies like Influchina can provide valuable support in navigating these complexities and ensuring campaign success.

How does Influchina assist luxury brands with influencer marketing in China?

Influchina specializes in connecting luxury brands with suitable influencers, offering services that include strategy development, influencer selection, campaign management, and performance analysis. Their deep understanding of the Chinese market and established relationships with influencers make them a valuable partner for brands aiming to succeed in this space.

What are common mistakes international luxury brands make in China?

Copying global campaigns without localization

Relying solely on celebrity endorsements

Ignoring micro-influencers or KOCs

Overlooking ongoing community engagement

These missteps weaken trust and authenticity.

Should luxury brands focus only on Tier 1 cities?

No. Tier 2 cities like Chengdu and Hangzhou are growing rapidly, with consumers who are equally fashion-forward and digitally active. Brands expanding regionally capture untapped markets and early loyalty.

How do agencies like InfluChina help luxury brands succeed?

Agencies provide end-to-end campaign management — from influencer vetting and negotiation to localized content creation, paid amplification, and performance tracking — ensuring that Western luxury standards are perfectly aligned with Chinese digital culture.