Mobile payment methods in China have become increasingly significant in recent years, especially in the asian country. In a world where consumers seek instant convenience, mobile payments streamline the process.

These systems operate through software linked to your smartphone, smartwatch, or tablet, connecting with your credit card or bank account. By simply downloading an app or “digital wallet,” users can pay for goods and services without the need for cash or a physical credit card.

China has been at the forefront of the mobile payments revolution, with platforms like Alipay and WeChat Pay leading the charge. As of the latest reports, over 85% of urban Chinese consumers use mobile payments, making it one of the most widely adopted payment methods in China.

The convenience, security, and widespread acceptance of these platforms have made them integral to daily life in China, from shopping and dining to public transportation and even street vendors.

As of the latest reports, over 85% of urban Chinese consumers use mobile payments, making it one of the most widely adopted payment methods in China

This article will provide a comprehensive overview of mobile payment methods in China, covering how they work, the primary platforms, and their impact on the economy and consumer behavior.

1. China: a cashless society

During the COVID-19 pandemic, the world witnessed significant technological advancements, with many businesses and countries promoting digital payments among their citizens. Specifically, two-thirds of adults now make or receive digital payments, an increase from 35% in 2014 to 57% in 2021. China is undoubtedly leading the way in cashless payment adoption.

The use of cash has been rapidly declining, starting with the widespread adoption of credit cards and now accelerated by the convenience and speed of mobile payments. According to the latest survey by the People’s Bank of China, cash usage accounts for only 23% of transactions, while mobile payment methods in China represent around 66% of all transactions.

According to the latest survey by the People's Bank of China, cash usage accounts for only 23% of transactions, while mobile payment methods in China represent around 66% of all transactions.

Furthermore, the number of digital consumers in China has grown significantly. Even before the pandemic, e-commerce accounted for nearly 25% of all retail purchases in China, surpassing countries like the United States and Germany. Post-pandemic, China’s e-commerce sector accounts for nearly 50% of global online retail sales, highlighting its dominant position in the market.

Therefore, there is no doubt that China is the global leader in mobile payment adoption, both in terms of user numbers and penetration rates. As previously mentioned, around 85% of urban Chinese consumers regularly use mobile payment systems. For businesses looking to enter the Chinese market, mastering online and mobile payment methods in China is essential.

2. How online payment works in China

As previously mentioned, cash is becoming a thing of the past in China. Chinese consumers use mobile payment platforms for a wide range of transactions, including dining at restaurants, ordering food delivery, shopping both online and offline, paying bills, and using various services. Approximately 99.8% of mobile payment users in China report making daily transactions, with 54.9% using mobile payments up to three times a day.

Approximately 99.8% of mobile payment users in China report making daily transactions, with 54.9% using mobile payments up to three times a day.

Mobile payment methods in China have been widely adopted for over a decade, and users are well-accustomed to the system. However, payment methods in China differ from those commonly used elsewhere. In China, all mobile payment systems are unified and operate primarily through QR codes. The platforms generally offer two options for online transactions:

- Scanning a QR Code: To make a payment or receive money, users can scan a QR code displayed on another person’s phone, a physical or virtual store, social media shop, etc. Once the code is scanned, the amount is displayed on the user’s phone, and the transaction can be completed with a single click.

- Generating a QR Code: This option involves the buyer or seller generating a QR code with a set amount, which the other party scans to complete the transaction.

Mobile Payments in China are revolutionizing consumer behavior, offering numerous benefits for both consumers and merchants, including convenience, speed, and security. These advancements highlight the importance of understanding and integrating online and mobile payment methods for businesses looking to succeed in the Chinese market.

3. Advantages of mobile payment methods in China

Given that mobile payments in China are a rapidly growing factor, it’s important to understand their benefits, especially if you’re looking to expand your market in China. Here are some of the most significant advantages:

- Increased Convenience for Customers: this is one of the most obvious yet crucial benefits. Mobile payments enhance the customer experience by making the purchasing process faster and more flexible, which is particularly important in China’s fast-paced consumer market.

- Simplified Accounting: for sellers, mobile payment methods in China simplify the collection of relevant financial information. Businesses can easily access comprehensive sales data, payment records, purchase frequency, average spending, and real-time updates, improving financial management and business efficiency.

- Ease of Integrating Loyalty Programs: mobile payment methods in China allow businesses to access customer data such as email addresses, names, and birth dates. This information can be utilized to create targeted loyalty programs, offering benefits like rewards for frequent purchases, personalized discounts, and other customer engagement strategies.

- Enhanced Security: security is a critical aspect of mobile payment methods in China. The systems are continually updated with advanced security features and data protection measures. Transactions typically require biometric verification, such as fingerprints or facial recognition, alongside encryption, providing a secure environment for both consumers and merchants.

- Increased Number of Transactions: The widespread use of mobile payment methods in China has made it essential for businesses to offer these options. Not having mobile payment capabilities could result in lost sales, as a significant portion of the Chinese consumer base prefers or exclusively uses these methods.

4. Mobile payment platforms in China

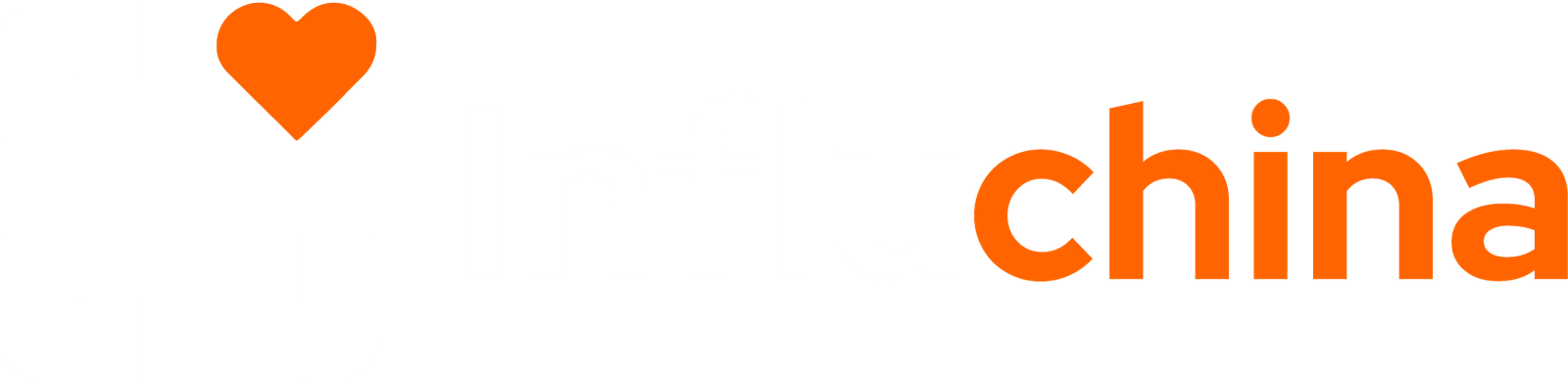

While mobile payments are still relatively new in the West, mobile payment methods in China have been a leading trend since 2004 with the launch of Alipay. WeChat Pay soon followed, along with several other companies. However, when it comes to the market share of mobile and online payments in China, WeChat Pay and Alipay are the undisputed leaders. According to Statista, approximately 90% of online payment users in China used these providers in the last year.

However, when it comes to the market share of mobile and online payment methods in China, WeChat Pay and Alipay are the undisputed leaders.

China’s market is vast and continually expanding, with an increasing number of consumers opting for mobile payments. Here are the top mobile payment platforms in China:

Alipay

Alipay holds around 55% of the online payment market share in China. Beyond being the most popular payment provider in China, Alipay is also the world’s largest mobile payment platform, boasting over 1.3 billion users in 2022. Alipay has developed partnerships with numerous national Chinese banks, providing secure, reliable, and convenient payment systems.

Alipay ensures consumer protection by transferring funds only after the buyer is satisfied with the product. This system’s integration with major e-commerce platforms like Taobao and Tmall significantly contributes to its dominance in mobile payment methods in China.

This system's integration with major e-commerce platforms like Taobao and Tmall significantly contributes to its dominance in mobile payment methods in China.

WeChat Pay

Launched in 2013, WeChat Pay quickly became a major player in the mobile payment landscape. It allows users to transfer money using QR codes and pay for a wide range of services, including taxis, purchases in WeChat stores, groceries, food delivery, airline tickets, and restaurant bills. WeChat Pay also offers a saving feature, enabling users to deposit money within the app for future use. With over a billion users, WeChat Pay is integral to daily life in China.

It allows users to transfer money using QR codes and pay for a wide range of services, including taxis, purchases in WeChat stores, groceries, food delivery, airline tickets, and restaurant bills.

Baidu Wallet

Baidu Wallet, developed by the Chinese internet giant Baidu, operates similarly to Apple Wallet. It allows users to make payments, conduct transfers, and store tickets and coupons for easy access. While not as dominant as Alipay or WeChat Pay, Baidu Wallet is a notable player in the mobile payment methods in China.

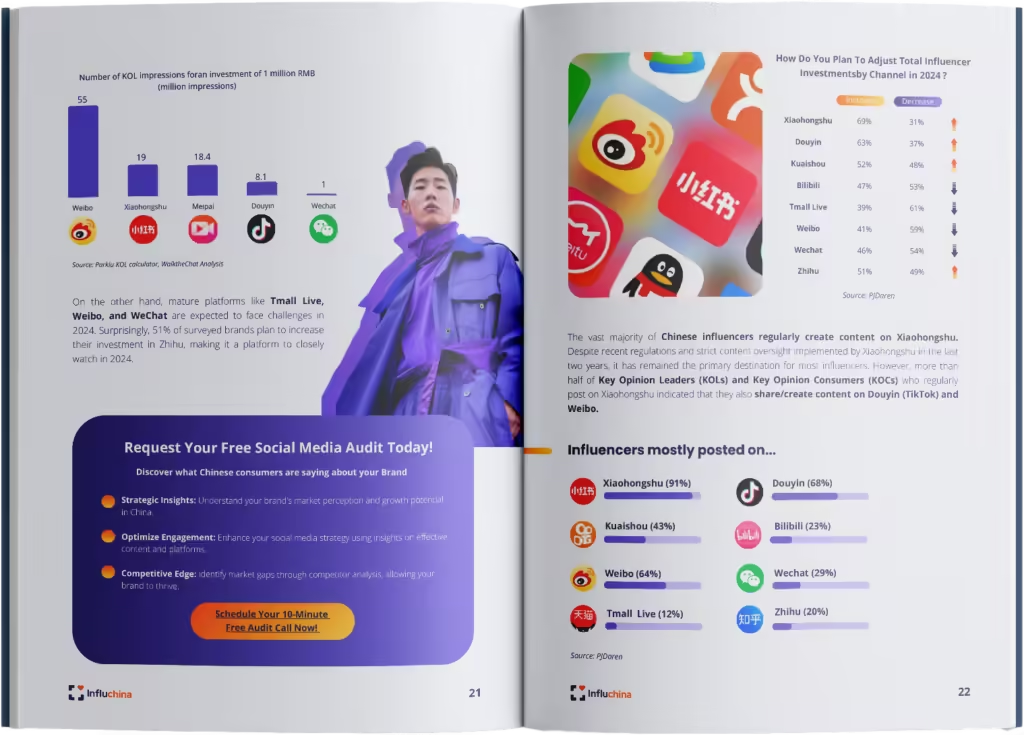

Apple Pay and Huawei Pay

Both of these systems offer similar functionalities, allowing users to pay for goods and services using integrated payment apps on their respective devices. These apps can be linked to various Chinese bank accounts or international credit cards, catering especially to tech-savvy users and those with international needs.

Tenpay

Often compared to the popular Western service Bizum, Tenpay allows businesses and consumers to send and receive payments quickly and securely. It also facilitates mobile device top-ups, further embedding itself in the daily financial activities of its users.

UnionPay QuickPass

UnionPay, a major bank card service in China, offers a mobile payment solution called QuickPass. This service allows users to make payments by scanning QR codes or tapping their phones on contactless readers. It’s widely accepted across China, particularly in sectors like transportation, retail, and hospitality.

JD Pay

Operated by the e-commerce giant JD.com, JD Pay is another significant mobile payment platform. It is used extensively on JD’s own platforms but also across various offline merchants. JD Pay offers similar features to other major players, including QR code payments and integration with loyalty programs.

It is used extensively on JD's own platforms but also across various offline merchants.

While these are the primary platforms, many other mobile payment platforms in China exist. It’s crucial to understand that Chinese consumers typically do not rely on a single payment provider; they use multiple platforms simultaneously, depending on the type of purchase. For example, they might use Alipay for shopping on Taobao and WeChat Pay for transferring money to friends or paying bills. Engaging with an expert in the Chinese market is advisable to navigate the complexities of these widely used applications and to effectively leverage the benefits of mobile payment methods in China.

It's crucial to understand that Chinese consumers typically do not rely on a single payment provider; they use multiple platforms simultaneously, depending on the type of purchase.

Platform | Main Uses | Key Features |

Alipay | E-commerce transactions, in-store payments, bill payments, money transfers, mobile top-ups | Widely accepted, secure transactions, integrates with major Chinese banks, supports international payments |

WeChat Pay | Social media and online shopping payments, in-store payments, money transfers, bill splitting, travel bookings | Integrated with WeChat app, wide acceptance, easy money transfer and payment split features, strong user base |

UnionPay QuickPass | General retail payments, transportation, hospitality, ATM cash withdrawals | Supported by UnionPay’s vast network, contactless payments, QR code payments, international acceptance |

JD Pay | E-commerce transactions, in-store payments, money transfers, mobile top-ups, loyalty programs | Tied to JD.com ecosystem, loyalty rewards, strong e-commerce integration, secure transactions |

5. Conclusion

In conclusion, it can be said that China has moved beyond cash as a primary form of payment. Now, over 80% of consumers opt for mobile payment methods in China, with more than ten platforms available.

Mobile payments in China have undoubtedly revolutionized consumer behavior and are here to stay. This trend is particularly significant in China, where the adoption rate is remarkably high. It is crucial to seek professional advice, as these payment providers operate differently from those in the West.

If you need assistance with marketing in China, Influchina can help you develop the best digital marketing strategies for the Chinese market.

FAQ

FAQs on Mobile Payment Methods in China

What are the most popular mobile payment platforms in China?

- The most popular mobile payment platforms in China are Alipay and WeChat Pay. These platforms dominate the market and are widely used for a variety of transactions, including shopping, bill payments, and money transfers.

Why are mobile payments so popular in China?

- Mobile payments are popular in China due to their convenience, security, and widespread acceptance. The infrastructure supports a cashless society, and users enjoy the ease of making transactions without carrying physical cash or cards.

What are the benefits of integrating mobile payment platforms like Alipay and WeChat Pay?

- Integrating Alipay and WeChat Pay can improve customer satisfaction through streamlined checkout processes, enable access to valuable consumer data for marketing purposes, and facilitate participation in popular loyalty and promotional programs.

How can businesses in China integrate mobile payment options?

- Businesses in China can integrate mobile payment options by partnering with platforms like Alipay and WeChat Pay. This involves setting up the necessary infrastructure, such as QR code payment systems, and ensuring compliance with local regulations. It’s essential for businesses to offer these payment options to cater to consumer preferences and remain competitive in the market.

How can my business set up to accept Alipay and WeChat Pay?

To accept Alipay and WeChat Pay, businesses need to register with these platforms, which involves providing business credentials and linking to a Chinese bank account. After approval, you can use QR codes or POS systems compatible with these payment methods. Our team can assist you through this setup process, ensuring a smooth and efficient integration into your business operations.