In the dynamic digital landscape of China, Chinese social media influencer marketing has become a pivotal strategy for brands looking to engage with a vast and diverse consumer base. With platforms like WeChat, Douyin (the Chinese counterpart of TikTok), and Xiaohongshu (also known as RedNote) dominating the social media sphere, the demand for effective Influencer Management Software in China is higher than ever.These specialized tools empower brands to identify, collaborate with, and analyze the performance of Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs), ensuring campaigns resonate with target audiences and achieve desired outcomes. As the influencer ecosystem continues to evolve, leveraging advanced management software is essential for brands to navigate the complexities of China’s unique digital environment and maintain a competitive edge.

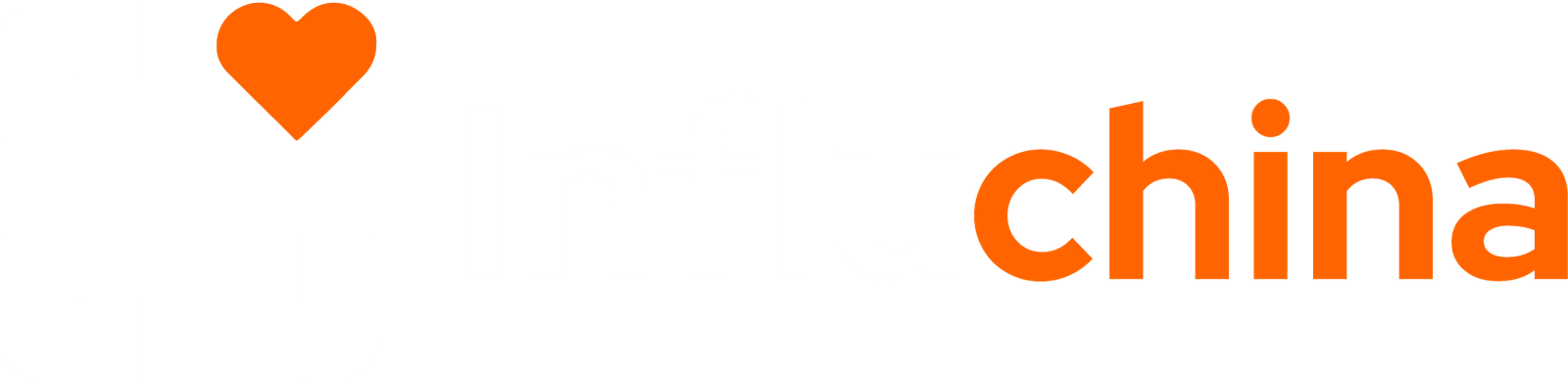

1. Understanding the Influencer Landscape in China (2025 Overview)

China’s influencer marketing ecosystem is vastly different from the Western landscape, shaped by Chinese social media platforms, a strong preference for trust-based recommendations, and a well-defined influencer hierarchy. As brands compete in this rapidly evolving space, leveraging the right Influencer Management Software in China is essential to navigate the complexities of the market effectively. To succeed, businesses must understand the different influencer tiers and the role of Xiaohongshu, Douyin, and WeChat in shaping consumer decisions and driving impactful influencer collaborations.

In China, influencers are classified into five main categories, depending on their reach, engagement, and influence:

- Key Opinion Consumers (KOCs): Regular consumers who share authentic experiences and product reviews. They are highly influential on Xiaohongshu, where users trust peer recommendations over traditional ads.

- Nano-Influencers: They have small but highly engaged audiences and are ideal for hyper-local or niche campaigns. Their opinions feel more personal, making them valuable for conversion-driven marketing.

- Micro-Influencers: These influencers maintain a strong connection with their followers, making them effective for driving brand awareness and trust. Their opinions feel genuine, and they tend to have higher engagement rates than macro or mega-influencers.

- Macro-Influencers: These influencers bridge the gap between authenticity and mass appeal. They are often experts in a particular niche (e.g., fitness, beauty, tech) and work well for product launches and larger campaigns.

- Mega-Influencers & Celebrities: These top-tier KOLs have millions of followers and dominate platforms like Douyin and Weibo. They are costly but provide instant exposure and credibility.

In contrast to the Western influencer market, where micro-influencers are still growing in importance, China’s influencer landscape prioritizes trust over sheer follower count. This is why KOCs and nano-influencers play a crucial role in the consumer decision-making process.

Table Comparison: Influencer Tiers in China

Influencer Type | Follower Range (Varies by Platform) | Key Platforms | Best for |

Key Opinion Consumers (KOCs) | 500 – 5,000 | Xiaohongshu, WeChat Private Groups | Authentic peer recommendations, user-generated content |

Nano-Influencers | 1,000 – 10,000 | Xiaohongshu, WeChat, Douyin | Niche engagement, word-of-mouth marketing |

Micro-Influencers | 10,000 – 100,000 | Xiaohongshu, Douyin, Weibo | Targeted campaigns, high trust factor |

Macro-Influencers | 100,000 – 1M | Douyin, Weibo, Kuaishou | Large-scale brand awareness |

Mega-Influencers (Top KOLs & Celebrities) | 1M+ | Douyin, Weibo, Taobao Live | Mass exposure, brand reputation |

2. Best Social Media Platforms for Influencer Marketing in China

China’s influencer marketing landscape is deeply tied to platform-specific ecosystems, with each social network catering to different content formats, audience behaviors, and marketing strategies. Unlike Western platforms, where influencers often maintain a presence across multiple channels, KOL marketing in China operates differently—Chinese influencers typically specialize in one or two platforms, focusing on deep audience engagement rather than broad cross-platform visibility. This makes it essential for brands to carefully select the right platforms for their campaigns to maximize reach, credibility, and conversion rates.

Short-Video & Livestreaming Platforms

These platforms dominate China’s high-engagement content landscape, where short-form videos and livestreaming drive rapid consumer action and e-commerce integration.

As a crucial part of e-commerce in China, short-video platforms like Douyin and Kuaishou have revolutionized the way brands connect with consumers, offering interactive shopping experiences, influencer-driven promotions, and real-time purchasing options that enhance engagement and conversion rates.

- Douyin (China’s TikTok)

The leading short-video platform, often referred to as the Chinese version of TikTok, is widely used for viral marketing, product showcases, and livestream commerce.

- Influencers on Douyin can drive massive engagement, with short clips and challenges that boost brand visibility.

- Livestream shopping is a major trend, where influencers directly promote products in interactive sessions.

- Kuaishou

What is Kuaishou? Similar to Douyin but with a stronger presence in lower-tier cities and regional communities.

- Influencers here have high audience loyalty, making it an effective platform for brands targeting niche or regional markets.

Image & Text-Based Content Platforms

These platforms focus on product recommendations, community-driven discussions, and lifestyle inspiration, making them ideal for brand storytelling and consumer trust-building.

- Xiaohongshu (Little Red Book)

The go-to platform for beauty, fashion, wellness, and lifestyle content, where influencers create in-depth product reviews and recommendations, making it a key player in Xiaohongshu marketing.

Unlike short-video platforms, Xiaohongshu thrives on image and text-based posts, similar to Pinterest or Instagram but with a strong e-commerce focus. Brands looking to implement an effective Xiaohongshu marketing strategy often leverage user-generated content (UGC) to build authenticity and credibility, driving higher consumer trust and engagement.

For companies unfamiliar with the platform’s unique ecosystem, working with a Xiaohongshu marketing agency can help optimize strategies, connect with the right influencers, and ensure compliance with platform guidelines, ultimately maximizing brand visibility and conversion rates.

One of China’s oldest social media platforms, still widely used for brand announcements, trending topics, and influencer-driven discussions.

Many celebrities and macro-influencers engage in brand sponsorships and viral marketing campaigns on Weibo.

Long-Video & Knowledge-Sharing Platforms

For brands targeting audiences seeking in-depth content, educational insights, or niche interests, long-video and knowledge-sharing platforms play a crucial role.

- Bilibili

What is Bilibili? A popular long-video platform with a highly engaged Gen Z audience, often used for gaming, tech, and anime content.

- Unlike Douyin, Bilibili allows for deeper storytelling, making it ideal for brands looking to explain products in detail through influencer collaborations.

- Zhihu

knowledge-sharing platform similar to Quora, where professionals and industry experts answer questions and write in-depth articles.

- Brands use Zhihu for expert-backed content marketing, especially in industries like finance, tech, and healthcare.

Social Networking & Private Community Platforms

China’s digital marketing ecosystem heavily relies on private traffic strategies (私域流量), where brands engage with consumers through closed communities and personal interactions rather than public posts.

- WeChat Official Accounts (公众号): Used by brands and influencers to share detailed articles and exclusive content with their followers.

- WeChat Video Channels (视频号): A growing space for short-video and livestream content, helping influencers engage audiences in a more private and interactive way.

- WeChat Groups & Moments (微信群 & 朋友圈): Unlike traditional social media, influencers build exclusive communities where they can directly engage with loyal followers, promoting products and brand collaborations through private discussions.

3. What Is Influencer Management Software in China (and Why It Matters)?

With the rapid growth of influencer marketing in China, brands need efficient tools to manage influencer collaborations across multiple platforms. Unlike in the West, where centralized influencer marketing platforms operate across multiple social networks, China has platform-specific influencer management software that caters to the unique needs of each ecosystem.

There are three main types of Influencer Management Software in China:

- Platform-Specific Influencer Management Software (Developed by Social Media Platforms)

- Third-Party Influencer Marketing Tools (e.g., Launchmetrics, PARKLU, Robin8)

- Specialized Agencies like Influchina (Offering both influencer collaboration management and direct access for influencers to Chinese platforms)

4. Official Influencer Management Platforms in China (Douyin, Xiaohongshu, Weibo, Bilibili)

China’s leading social media platforms have developed their own built-in Influencer Management Software in China to connect brands directly with influencers (KOLs & KOCs). These platforms streamline collaborations, track engagement, and facilitate payments, providing businesses with a seamless and efficient way to launch influencer marketing campaigns in China. By leveraging these integrated tools, brands can optimize their influencer partnerships, enhance campaign performance, and maximize their return on investment (ROI) in China’s unique digital landscape.

Douyin (China’s TikTok) – Xingtu (星图) Official Influencer Platform

Xingtu (星图) is official douyin influencer management system, providing brands with access to certified KOLs and KOCs for paid collaborations.

Offers powerful promotional formats, including viral challenges, sponsored short videos, and livestream shopping events.

- Pros: High engagement, e-commerce integration, and access to platform-endorsed influencers.

- Cons: Requires expertise in China’s fast-paced content trends and a Chinese business license for direct platform use.

Kuaishou – Magnet (磁力聚星) Official Influencer Platform

Magnet (磁力聚星) is Kuaishou’s official KOL/KOC collaboration platform, allowing brands to connect with verified influencers.

- Well-suited for livestream e-commerce and regional marketing campaigns.

- Pros: Stronger audience loyalty than Douyin, making it effective for long-term brand partnerships.

- Cons: Less reach in first-tier cities, making it a better fit for brands targeting lower-tier urban and rural markets.

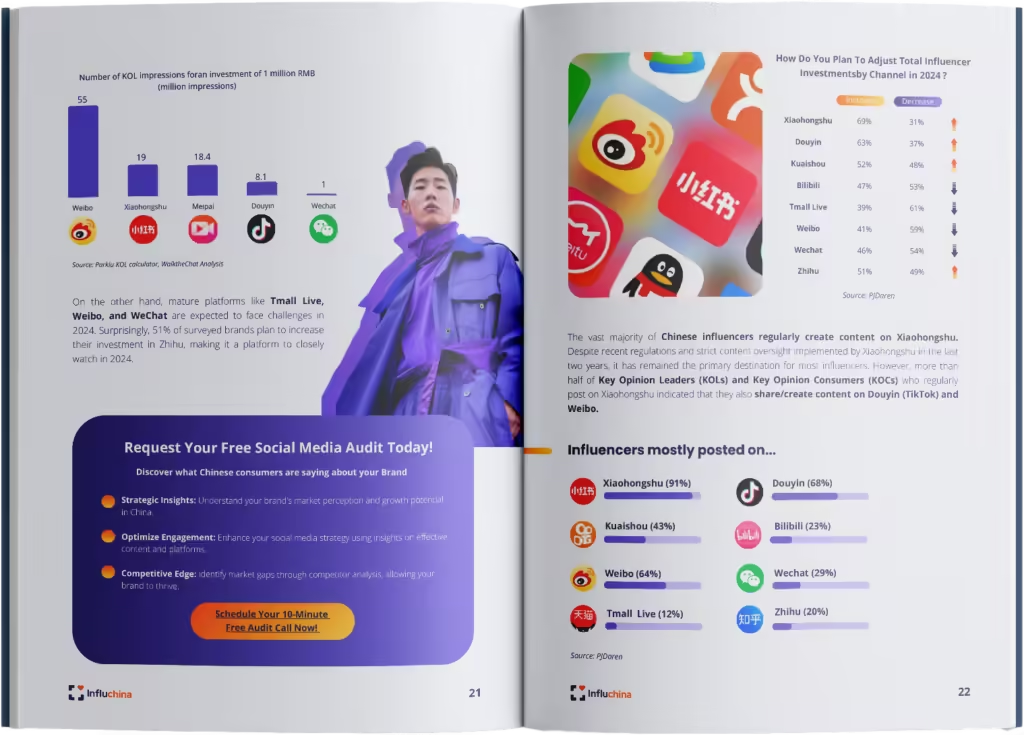

Xiaohongshu (Little Red Book) – Pugongying (蒲公英) Influencer Platform

Pugongying (蒲公英) is official Xiaohongshu influencer collaboration tool, helping brands connect with KOCs and micro-influencers for authentic peer-driven marketing.

Particularly popular in the beauty, fashion, wellness, and lifestyle sectors.

- Pros: Highly trusted by consumers, with user-generated reviews driving organic sales.

- Cons: Strict content moderation policies and challenging brand approval processes for new accounts.

Weibo – Weirenwu (微任务) Sponsored Content Platform

Weirenwu (微任务) is Weibo’s official influencer platform, allowing brands to launch sponsored campaigns with influencers across various categories.

- Ideal for macro-influencers, celebrity endorsements, and mass-market brand awareness campaigns.

- Pros: Great for viral marketing, trending hashtags, and brand storytelling.

- Cons: Lower conversion rates compared to platforms like Douyin and Xiaohongshu, as users engage more with news than shopping content.

Bilibili – Huahuo (花火) Brand Partnership Platform

Huahuo (花火) is Bilibili’s official brand collaboration tool, enabling sponsorship deals between brands and content creators (UP主).

- Pros: High audience engagement for in-depth product storytelling and tutorial-based marketing.

- Cons: Less suited for traditional product placements, as content is more entertainment-driven than e-commerce-focused.

Zhihu – Zhishi (芝士) Expert Collaboration Platform

Zhishi (芝士) is Zhihu’s official influencer collaboration platform, helping brands connect with experts for sponsored content and Q&A sessions.

- Pros: Ideal for industries like finance, healthcare, and technology, where consumers seek expert-backed recommendations.

- Cons: Limited reach outside professional and knowledge-based industries.

Advantages & Disadvantages of Platform-Specific Influencer Management Software

Advantages | Disadvantages |

Direct access to platform-certified influencers | Limited to a single platform (e.g., Weibo influencers cannot be used on Xiaohongshu) |

Transparent pricing and performance tracking | Requires a Chinese business license for direct access |

Higher engagement and conversion rates within the platform’s ecosystem | No cross-platform campaign management |

Integrated with platform algorithms for better visibility | Complex approval processes for ad campaigns |

5. Top Third-Party Influencer Tools in China (2025 Comparison

Some brands prefer to use third-party Influencer Management Software in China that works across multiple platforms. These tools help brands manage large-scale influencer campaigns and analyze performance metrics, providing insights into audience engagement and campaign effectiveness. However, despite their advantages, they often come with high subscription fees and limitations, making them less accessible for smaller brands or those looking for a more flexible approach to influencer marketing in China.

Popular Third-Party Influencer Management Tools

- Launchmetrics (Used by luxury and fashion brands)

- PARKLU (Multi-platform influencer analytics)

- Robin8 (AI-driven influencer matching)

- AdMaster (Focused on performance tracking)

Advantages & Disadvantages of Third-Party Influencer Tools

Advantages | Disadvantages |

Multi-platform influencer management | Expensive monthly fees |

AI-driven influencer recommendations | Many tools focus only on data but lack execution capabilities |

Campaign performance analytics | Brands still need to manually engage influencers |

Ideal for large-scale corporate campaigns | Lack of integration with live commerce platforms |

6. Influchina: The Most Efficient Alternative to Influencer Management Software in China

What Makes Influchina Different?

Influchina is a specialized china influencer agency that helps brands collaborate with influencers in China while also providing direct access to Chinese social media for Western influencers. Unlike platform-based tools, Influchina provides a fully managed, localized approach to influencer marketing.

Helping Brands Collaborate with Influencers in China

- Direct influencer management: Instead of relying on platform algorithms, Influchina selects the right KOLs/KOCs based on brand needs.

- Multi-platform execution: Works across Douyin, Weibo, Xiaohongshu, Bilibili, WeChat, and Kuaishou.

- No need for third-party tools: Eliminates costly SaaS fees.

- Better flexibility & pricing negotiation: Ensures better ROI by avoiding inflated influencer rates from agency-marked-up platforms.

- Download Our Free eBook on Influencer Marketing in China! If you’re looking to expand your brand in China, our comprehensive eBook covers everything you need to know about platforms, influencer tiers, campaign strategies, and best practices. Get your free copy now and start navigating China’s influencer landscape with confidence!

Download our free eBook on influencer marketing in China—packed with platform insights, campaign tips, and real examples to help you get started with confidence.

Helping Influencers Enter the Chinese Market

- Official access to Chinese platforms: Many Western influencers struggle to set up and manage accounts on Douyin, Xiaohongshu, and Bilibili due to platform restrictions and language barriers. Influchina provides full support, ensuring seamless registration and account management.

- Brand partnership matchmaking: We help foreign influencers secure collaborations with Chinese brands, connecting them with relevant opportunities to expand their reach and monetize their content in the Chinese market.

- Content localization & compliance: Adapting content for the Chinese audience is crucial for success. Influchina ensures that Western influencers’ content is optimized for cultural relevance, platform algorithms, and local regulations, helping them achieve greater engagement and visibility.

Ready to grow your influence in China? Contact Influchina today and take your talent management strategy to the next level!

Why Choose Influchina?

Advantages | Compared to Software Solutions |

Direct and personalized influencer management | No reliance on algorithm-driven influencer lists |

No need for a Chinese business license | Unlike platform-specific software, Influchina handles compliance |

Works with both brands and influencers | Provides access to Western influencers in China |

Flexible and cost-effective compared to SaaS solutions | No high monthly subscription fees |

Comparison: Official vs Third-Party vs Agency Approaches in China

When managing influencer campaigns in China, brands typically have three main routes:

using official influencer platforms, subscribing to third-party software, or partnering with a specialized influencer agency.

Each approach comes with distinct strengths, challenges, and suitability depending on brand size, objectives, and local experience.

Below is a practical comparison to help you evaluate which option best fits your China marketing strategy.

Criteria | Official Platforms (e.g. Douyin Xingtu, RED Pugongying, Weibo Weirenwu) | Third-Party Tools (e.g. PARKLU, Launchmetrics, Robin8) | Agency Solutions (e.g. Influchina, ParkLu Connect, KAWO |

Platform Coverage | Single platform only | Multi-platform data integration | Multi-platform execution + local partnerships |

Access Requirements | Requires Chinese business license and local entity | Subscription-based (some allow cross-border access) | No local license needed; managed through agency networks |

Cost Level | Medium (pay-per-campaign or usage fees) | High (subscription or annual license fees) | Flexible (project-based or retainer model) |

Campaign Control | Self-managed | Semi-automated dashboards | Fully managed and localized |

Data Accuracy | Verified influencer metrics from native platforms | Broader coverage but reliant on API access | Verified + contextualized by local managers |

Content Localization | Minimal | Basic translation support | Deep adaptation for language, tone, and culture |

Analytics & Reporting | Platform insights only | Comprehensive data dashboards | KPI-driven performance reports + strategic feedback |

Ideal For | Domestic Chinese brands | Global enterprises with in-house China teams | International SMEs and new entrants to China |

Which Option Is Best for You?

Use official platforms if you already have a Chinese business license and internal marketing team fluent in the local ecosystem.

Use third-party tools if your goal is to monitor influencers across multiple platforms and benchmark performance with advanced data.

Work with an agency if you want a cost-effective, done-for-you solution that includes cultural adaptation, influencer outreach, negotiation, and campaign management.

For most foreign brands, the agency model offers the best balance between efficiency, insight, and scalability — especially when entering the Chinese market for the first time.

Key Takeaway: While official and third-party tools provide valuable data, agency-led influencer management delivers the most practical path for international brands — combining technology with cultural expertise, content localization, and end-to-end KOL campaign support.

Trends Shaping Influencer Management in China (2025–2026)

The influencer marketing ecosystem in China is evolving rapidly — and so are the technologies, data systems, and consumer behaviors that drive it. To stay competitive, brands and agencies must adapt to these upcoming shifts that are redefining how influencer management works in China:

1. AI-Powered Influencer Discovery and Analytics

Artificial intelligence is transforming how brands identify and evaluate influencers.

Platforms like PARKLU AI and Robin8 now use machine learning to analyze engagement quality, detect fake followers, and predict campaign performance based on historical data.

For agencies, these insights mean more precise KOL selection and measurable ROI — replacing guesswork with data-driven accuracy.

2. Cross-Border KOL Collaborations Are on the Rise

The boundary between Chinese and overseas content ecosystems is becoming more fluid.

International brands are increasingly partnering with China-based influencers living abroad, bridging cultural gaps while maintaining local authenticity.

This approach enables smoother collaborations without regulatory barriers, especially for travel, luxury, and education sectors.

3. Integration of E-Commerce Data Within Influencer Platforms

China’s platforms are merging content and commerce at an unprecedented level.

Modern influencer software now connects directly to Douyin Shop, Taobao, and RED Mall, giving brands access to live sales metrics and conversion funnels.

This integration allows real-time optimization of content strategy — where every view, comment, and click can be traced to revenue impact.

4. Stricter Data Regulations and Platform Compliance

As China continues tightening its data privacy and advertising regulations, influencer tools must adapt.

Platforms now require clearer brand disclosures and compliance with KOL registration rules.

For international brands, this makes partnering with a licensed local influencer agency essential to ensure regulatory safety and data accuracy.

5. Hybrid Agency-Technology Models Are Emerging

The most effective influencer management today combines automation with human expertise.

While software helps track data and performance, agencies provide cultural adaptation, content strategy, and relationship management — elements that tech alone cannot replace.

This hybrid model, led by agencies like Influchina, ensures both operational efficiency and local market insight, offering a balance of analytics and authenticity.

6. Micro and Nano Influencers Gaining Strategic Value

Chinese consumers increasingly trust smaller, niche creators (KOCs) over celebrity endorsements.

Influencer software now includes micro-KOL tracking to help brands identify high-engagement creators with lower cost-per-action.

This shift reflects a wider move toward authenticity, community trust, and sustained relationships rather than short-term virality.

Key Takeaway: The future of influencer management in China is data-driven, compliance-ready, and community-focused. Brands that integrate both technology and local expertise — rather than relying solely on global SaaS tools — will be best positioned to thrive in China’s fast-changing social commerce landscape.

Bridging Technology, Strategy, and Local Insight

As the Chinese influencer ecosystem becomes more sophisticated, success will depend on a brand’s ability to blend the efficiency of technology with the expertise of local partners.

While influencer software helps collect data and automate tasks, it’s the combination of cultural understanding, real-time communication, and strategic content planning that ensures campaigns truly resonate with Chinese audiences.

For international brands, this means moving beyond software alone — and embracing hybrid solutions or agency partnerships that can manage KOL outreach, compliance, and storytelling under one unified strategy.

This balance between digital tools and human insight will define the next generation of influencer management in China.

Conclusion: How to Choose the Right Influencer Management Software (or Agency) in China

For brands looking to succeed in China’s influencer-driven market, selecting the right Influencer Management Software in China is essential to maximize campaign performance, drive engagement, and improve ROI. The choice of software depends on business goals, budget, and platform requirements.

- Platform-Specific Tools (Xingtu, Pugongying, Weirenwu, etc.)

These official influencer management platforms offer deep integration with their respective social networks, making them ideal for brands looking for precise audience targeting and native engagement tracking. However, they come with limitations, as they are restricted to one platform at a time and often require a Chinese business license to access.

- Third-Party SaaS Tools (Launchmetrics, PARKLU, Robin8, AdMaster, etc.)

These solutions provide cross-platform access and valuable performance analytics, making them useful for global brands running large-scale campaigns. However, they come with high subscription fees and require manual influencer engagement, making them less practical for businesses looking for a fully managed influencer marketing solution.

- Influchina – The Most Efficient Influencer Agency in China

Unlike platform-specific tools or SaaS software, Influchina is a fully customized, influencer agency in China that offers a personalized, agency-based approach to influencer marketing. By providing direct access to influencers, flexible campaign execution, and multi-platform management, Influchina eliminates the need for third-party platforms, allowing brands to streamline influencer collaborations without unnecessary fees or intermediaries.

Additionally, Influchina bridges the gap between Western influencers and the Chinese market, helping international creators establish a presence on platforms like Douyin, Xiaohongshu, and Bilibili. By working with this specialized influencer agency in China, both brands and influencers can navigate the complexities of the Chinese digital ecosystem, ensuring successful collaborations and maximizing engagement with target audiences.

By leveraging the right Influencer Management Software in China, brands can optimize their china marketing strategy, enhance engagement, increase sales, and build long-term brand loyalty within China’s competitive digital landscape.