TL;DR | China Market Entry Strategy

Entering China offers major growth potential, but success depends on making the right strategic choices early. A strong China market entry strategy starts with China-specific market research (consumer behaviour, competitors, platform dynamics, and regulations), then choosing the most suitable entry route: cross-border eCommerce (CBEC), domestic eCommerce, distributor/retail partner, or offline-first.

Once the entry route is clear, brands need a complete localisation foundation—Chinese brand name, China-adapted positioning, localised product pages and visuals, service readiness, and trademark/IP protection—before scaling marketing spend. Finally, execution should follow a structured rollout: a 90-day roadmap to validate demand, build trust (reviews, UGC, KOC/KOL), launch campaigns, and optimise using clear KPIs (traffic sources, conversion, ratings, response time, and retention). This guide breaks down the practical steps to enter China with clarity and scale sustainably.

Entering the Chinese market has become an increasingly critical consideration for Western companies of all sizes. Despite the challenging global economic climate, exacerbated by the COVID-19 pandemic, China has maintained robust economic growth, with a GDP increase of 8.44% in 2021.

As the world’s second-largest economy, closely following the United States, China is poised to remain a significant engine of global growth for the next decade. For companies in the B2B sector in China, understanding how to penetrate this vast and complex market is essential.

China is poised to remain a significant engine of global growth for the next decade.

Several factors have contributed to making China an attractive destination for Western businesses. Rapidly evolving demographics, rising incomes, increased consumer spending, and an increasingly open business environment have all played a role in this shift. Additionally, the stagnation or decline of sales in their home markets has driven many US and European companies to prioritize China in their long-term global growth strategies.

However, successfully entering the Chinese market can be a daunting challenge for foreign companies, especially those with limited or no prior experience in the region. Understanding the nuances of Chinese business culture, navigating regulatory hurdles, and adapting to local market conditions are just a few of the complexities that companies must address.

1. Evaluating your Readiness to Enter the Chinese Market

Tapping into China’s ongoing economic growth offers a promising opportunity, but not every foreign brand is fully prepared to take this step. Successfully entering the Chinese market requires significant time, effort, and a substantial investment of resources.

Successfully entering the Chinese market requires significant time, effort, and a substantial investment of resources.

The financial commitment can vary greatly depending on the size of your business. For instance, your marketing budget might need to range anywhere from $25,000 to over $1 million. The timeline for reaching this level of investment will depend on your business objectives and how aggressively you intend to pursue the market.

For instance, your marketing budget might need to range anywhere from $25,000 to over $1 million.

It’s also crucial to consider consumer preferences when planning your entry strategy. To gauge whether your target audience in China is already interested in your products or services, you can check Chinese social media platforms for mentions of your brand or explore e-commerce sites to see if your products are being resold unofficially. These insights can help you assess the potential demand and better prepare for a successful market entry.

2. Conduct Comprehensive Market Research and Preliminary Analysis

If you’re looking to enter the Chinese market successfully, gaining a deep understanding of local consumer behavior is essential. Before you begin seeking local partners or selecting distribution channels, it’s crucial to conduct thorough market research in China to determine whether there is genuine interest in your products or services among Chinese consumers.

Your research should also assess the competitive landscape. Determine whether your target market is already dominated by a well-established domestic competitor. For example, consider Amazon’s experience when it entered China through a joint venture with Joyo.com in 2017. Despite its global brand strength, Amazon struggled to compete with popular local marketplaces like Tmall and JD.com, ultimately leading to its exit from the Chinese online retail market in 2019.

If your research indicates that your target market isn’t dominated by a strong local competitor, that’s an encouraging sign. However, if there is strong competition, take the time to explore social media platforms to see if consumers are expressing dissatisfaction with existing options—this could present an opportunity for your brand.

Your research should also assess the competitive landscape. Determine whether your target market is already dominated by a well-established domestic competitor.

Another positive indicator of demand for your products in China is the presence of “Daigou” sellers. These individuals purchase products abroad in bulk to resell in China, highlighting a potential market for your offerings.

It’s important to note that Chinese consumers don’t typically rely on search engines like Baidu to find products or brands. Therefore, when conducting your market research, prioritize e-commerce and social media platforms such as WeChat, Weibo, Red Book, Douyin, Kuaishou, and Bilibili. These platforms are vital for understanding consumer preferences and market trends in China.

When conducting your market research, prioritize e-commerce and social media platforms such as WeChat, Weibo, Red, Douyin, Kuaishou, and Bilibili.

3. China Market Entry Routes: Choose the Best Model (CBEC vs Domestic vs Distributor vs Offline)

When entering China, one of the biggest early decisions is how you will enter—because your entry route affects your budget, timelines, compliance requirements, logistics, and the channels you can scale on later.

Below are the most common market entry models for foreign brands, and how to choose between them.

Entry Route | What It Means | Best For | Pros | Cons |

Cross-border eCommerce (CBEC) | Sell imported goods into China via cross-border channels | Brands testing demand or entering without a full local setup | Faster market entry, lighter local setup, strong demand for imported products | Longer delivery times, platform requirements, needs strong marketing |

Domestic eCommerce (onshore) | Operate locally with China-based compliance + faster delivery | Brands committed to scaling long-term in China | Faster shipping, deeper platform integration, stronger scale potential | Higher compliance, longer setup, bigger operational commitment |

Distributor / Retail Partner | Sell through a local distributor or retail partner | B2B, wholesale-focused, or brands wanting a lighter direct-to-consumer workload | Faster access to existing networks, lower direct operational burden | Lower margin control, weaker brand control, partner dependency |

Offline-first / Hybrid | Physical presence (stores, pop-ups, showrooms) + digital | Premium, luxury, experiential categories | Trust-building, strong brand credibility | High cost, slower scaling, still needs digital strategy |

Quick Decision Guide (so readers don’t get stuck)

Choose Cross-border if your priority is testing demand, building early awareness, or entering without a full China entity setup.

Choose Domestic if you already have strong proof of demand and want fast delivery + long-term scale.

Choose a Distributor model if your category relies heavily on trade relationships or you want a “local network” path to market.

Choose Offline-first if product experience and trust are critical (premium, luxury, high-involvement categories), but still support it with digital channels.

A strong strategy often starts with one model and expands into another later (for example, testing cross-border first, then moving into domestic channels once the business case is proven).

4. Building Strong Domestic Partnerships & Collaborating with Local Experts

One of the primary challenges foreign companies face when entering the Chinese market is the lack of local knowledge, which is critical for achieving sustainable growth. To navigate this complex environment successfully, partnering with a marketing agency that is deeply familiar with the Chinese market is highly advisable.

While working with a top-tier marketing agency may seem like a significant initial investment, this expense is justified by the long-term benefits. A knowledgeable agency can help you avoid costly missteps by ensuring that your branding, messaging, and campaigns are culturally resonant and strategically aligned with local market dynamics. In the dynamic and sometimes unpredictable Chinese market, having robust marketing support can be the difference between success and failure.

In the dynamic and sometimes unpredictable Chinese market, having robust marketing support can be the difference between success and failure.

Beyond marketing expertise, a reliable trading partner (TP) is also crucial for foreign enterprises. These local companies act as your gateway to China’s major e-commerce platforms, such as Taobao, Tmall, and JD.com. They manage your distribution channels, oversee your online store operations, handle inventory, and coordinate logistics. With the rapid growth of e-commerce in China, having a capable TP partner is essential for seamlessly integrating into the market and scaling your operations effectively.

For brands looking to navigate these complexities, exploring tailored China retail solutions can be a smart move. These solutions combine local insight, operational support, and retail strategy to help businesses succeed in a competitive and fast-evolving marketplace.

With the rapid growth of e-commerce in China, having a capable TP partner is essential for seamlessly integrating into the market and scaling your operations effectively.

In today’s China, where consumer preferences and market dynamics can shift rapidly, collaborating with local experts—particularly in marketing—is not just beneficial; it’s essential for any foreign company aiming to thrive in this vast and complex market.

5. Localise your Brand to Successfully Enter the Chinese Market

When you enter the Chinese market, it becomes clear that a localized brand is essential for establishing a strong presence and resonating with Chinese consumers. One critical element of this localization is your trading name. It’s important to recognize that not all Chinese consumers speak English, making it crucial for your brand name to be both understandable and memorable in Mandarin.

It's important to recognize that not all Chinese consumers speak English, making it crucial for your brand name to be both understandable and memorable in Mandarin.

Your brand name should be easy to pronounce in Mandarin, carry positive connotations, and leave a lasting impression. This goes beyond simple translation—it’s about creating a meaningful cultural connection. For instance, the brand “Burger King” adapted its name to 汉堡王 (Hànbǎo Wáng), which directly translates to “Hamburger King.” This name not only maintains the brand’s identity but also resonates with local consumers by being easy to pronounce and relevant to the product.

In addition to your brand name, all your brand content on your website, social media profiles, and e-commerce platforms should be in the local language. This is vital for engaging Chinese consumers effectively and ensuring your messaging is clear and impactful.

When planning to enter the Chinese market, it’s also essential to consider intellectual property rights (IPR). China operates on a ‘first-to-file’ basis for patents and trademarks, meaning that the first entity to register the name gains the rights. This can pose challenges if a local company registers your brand name before you do. To protect your brand, it’s crucial to register your trademarks and patents across various categories as early as possible.

China operates on a ‘first-to-file’ basis for patents and trademarks, meaning that the first entity to register the name gains the rights.

6. China Localisation Checklist (Brand Name, Content, Product Pages, IP)

Localisation in China is not only translation. It’s the process of making your brand feel native, trustworthy, and easy to understand—especially when consumers discover you through social platforms and marketplaces.

Use this checklist to make sure your localisation is complete before you scale marketing spend.

Area | What You Need | Why It Matters |

Chinese brand name | A Mandarin brand name that is easy to say, memorable, and has positive meaning | Improves recall, trust, and word-of-mouth |

Messaging & positioning | Clear China-specific value proposition (not copied from global copy) | In China, positioning needs to match local expectations and competitor norms |

Product pages in Chinese | Chinese copy, benefits, usage guidance, FAQs, and trust signals | Conversion depends heavily on clarity + credibility |

Visual localisation | China-friendly product visuals, lifestyle context, and platform formats | Platform-first buying relies on visual trust |

Social proof | Reviews, UGC, KOC content, KOL credibility signals | Consumers trust peer and influencer recommendations strongly |

Customer service readiness | Mandarin support and fast response expectations | Service speed affects ratings and repeat purchase |

Trademark/IP protection | File trademarks early and across relevant categories | China is first-to-file—protect your name before scaling awareness |

Tone & cultural fit | Avoid literal translations and adapt tone to Chinese consumer culture | Small cultural mistakes can reduce trust quickly |

What most foreign brands get wrong

They translate global copy directly instead of adapting positioning for local competitors.

They start paid campaigns before brand name, product pages, and service readiness are solid—leading to wasted spend.

They delay trademark/IP decisions until after visibility increases (when it’s more risky and costly).

If you want your entry to succeed, treat localisation as a launch requirement, not a “later improvement.”

7. Choosing the right Marketing and Sales Channels

When planning to enter the Chinese market, it’s essential to have a deep understanding of the country’s rapidly evolving business landscape. A crucial decision for any foreign brand is whether to focus on establishing a physical presence through brick-and-mortar stores or to prioritize e-commerce platforms like Tmall, JD.com, or emerging players like Pinduoduo.

E-commerce is undeniably a powerhouse in China, with platforms like Tmall and JD.com dominating the online retail space. However, having a physical presence—whether through flagship stores, pop-up shops, or showroom experiences—can significantly boost your brand’s visibility and credibility. Physical stores offer consumers the opportunity to engage with your brand in person, which can be particularly important in establishing trust, especially for new entrants.

If your strategy leans towards online sales channels, be prepared for a thorough and potentially lengthy preparation process. Successfully launching on major Chinese e-commerce platforms involves navigating trademark registrations, securing necessary licenses, and setting up a reliable supply chain. This process can take three to six months or even longer, depending on the complexity of your product offerings and the regulatory environment. Partnering with a trusted China E-commerce Agency can simplify this process, providing localized expertise, platform setup, and ongoing operational support tailored to your brand’s goals.

Successfully launching on major Chinese e-commerce platforms involves navigating trademark registrations, securing necessary licenses, and setting up a reliable supply chain.

Selecting the right social media platforms is equally critical when you enter the Chinese market. The choice of platform should align with your brand’s target audience and product type. For instance, fashion and beauty brands tend to thrive on platforms like Weibo and Xiaohongshu (Little Red Book), where influencer marketing and user-generated content drive consumer engagement. Meanwhile, brands in the tech or gaming sectors might find better traction on platforms like Bilibili or Douyin, which cater to younger, more tech-savvy users.

Moreover, timing your market entry around major e-commerce events like Singles’ Day (11/11) or the Spring Festival can provide a significant boost to your brand’s visibility and sales. These events are cultural phenomena in China, with consumer spending reaching its peak. For example, during the 2023 Singles’ Day event, Alibaba and JD.com collectively generated over $156 billion in sales, showcasing the immense potential these events hold for new market entrants.

8. Developing a Long-Term Strategy to Enter the Chinese Market

To successfully enter the Chinese market, your long-term strategy must align with the digital habits of your target consumers. Focus on the platforms they use, engage with influencers, leverage content marketing, and explore live streaming opportunities to connect with your audience.

To successfully enter the Chinese market, your long-term strategy must align with the digital habits of your target consumers.

Chinese consumers value personalized communication, making platforms like WeChat, with its robust CRM tools, essential for building strong customer relationships. Tailor your approach based on your brand’s position—niche leaders with an existing fan base may see quicker returns, while lesser-known brands in competitive fields will need more time, broader strategies, and greater investment.

9. China Market Entry Roadmap: 90-Day Plan + KPIs to Track

Most brands fail in China not because the market is too big, but because execution becomes unclear after the strategy slide deck. A simple 90-day roadmap helps you launch with structure and reduce mistakes.

90-Day China Entry Roadmap (Practical)

Days 1–30: Validate and prepare

Confirm target audience by platform + city tier

Finalise entry route (cross-border, domestic, partner-led)

Lock Chinese brand name and core messaging

Complete trademark/IP plan

Build China-ready product pages and content assets

Days 31–60: Build channels and trust

Set up store or partner distribution

Finalise logistics approach and customer service coverage

Start KOC seeding and early UGC generation

Run small test campaigns to validate positioning and pricing

Prepare KOL shortlist based on category fit and conversion potential

Days 61–90: Launch and optimise

Launch structured campaigns (KOL + paid + platform promotions)

Scale what works: top SKUs, top creatives, top segments

Improve conversion through reviews, FAQs, and customer support workflows

Track performance weekly and adjust fast (China moves quickly)

KPI | What It Tells You | Why It Matters |

Traffic sources | Where discovery actually comes from | Helps you pick channels that deserve more budget |

Conversion rate | Whether your listing, pricing, and trust signals work | Core indicator of product-market fit |

Add-to-cart / wishlist | Purchase intent before conversion | Shows whether consumers like the product but hesitate |

Reviews + rating | Trust and customer satisfaction | Affects platform visibility and future conversion |

Customer service response time | Operational readiness | Impacts complaints, ratings, and store reputation |

Repeat purchase / retention | Brand stickiness | Early sign of long-term potential |

This roadmap keeps strategy practical—so you don’t just “enter China,” you learn, iterate, and scale.

10. Leveraging KOL Influencers to Enter the Chinese Market

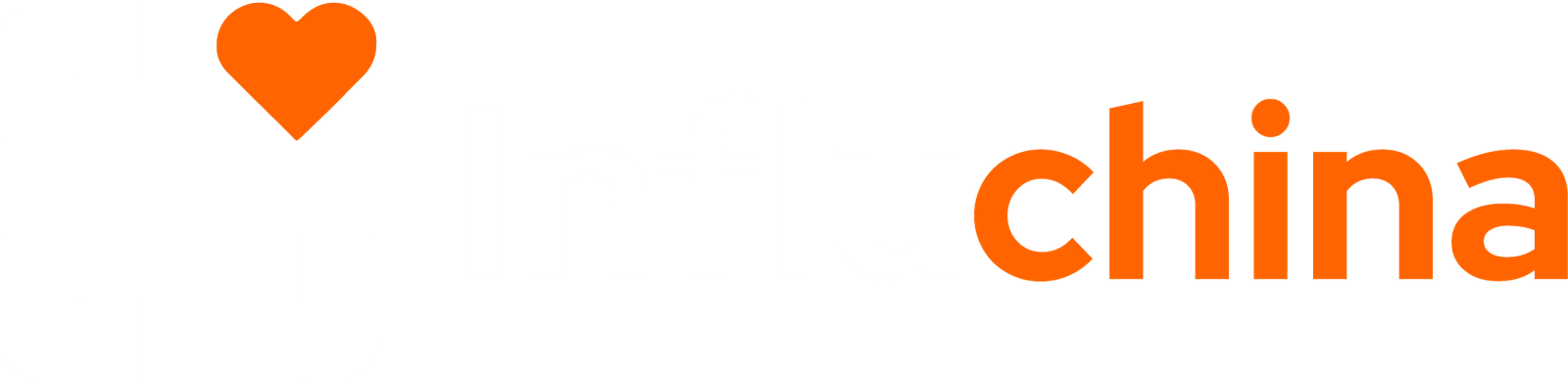

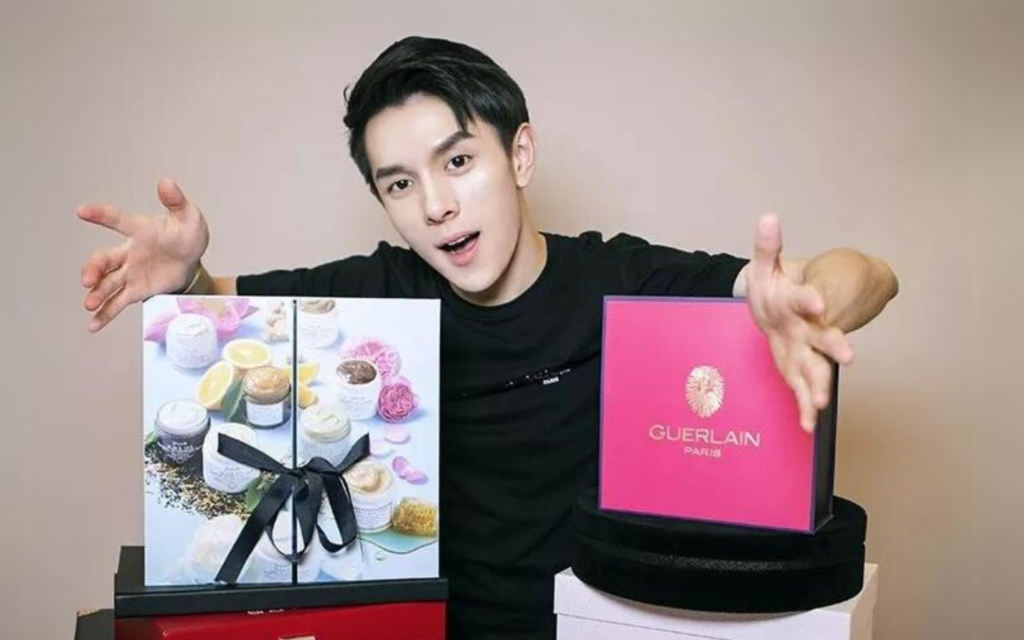

When planning to enter the Chinese market, collaborating with Key Opinion Leaders (KOLs) is a crucial strategy for success. KOLs, or influencers, have substantial followings on popular platforms like Weibo, Xiaohongshu, Douyin, and Bilibili, and their endorsements carry significant weight with Chinese consumers. For foreign brands looking to establish themselves, partnering with the right KOLs can dramatically boost brand awareness and credibility.

For foreign brands looking to establish themselves, partnering with the right KOLs can dramatically boost brand awareness and credibility.

In China, consumers trust recommendations from KOLs more than traditional advertising. This trust is built on the personal connection and authenticity that influencers offer, making their endorsements particularly powerful. By working with KOLs who resonate with your target demographic, your brand can reach and engage with Chinese consumers more effectively than through conventional marketing channels.

By working with KOLs who resonate with your target demographic, your brand can reach and engage with Chinese consumers more effectively than through conventional marketing channels.

Moreover, KOLs understand the cultural nuances and preferences of the Chinese market, enabling them to create content that aligns perfectly with local tastes. This cultural insight is invaluable in ensuring that your brand’s message is both relevant and impactful. To make the most of these opportunities, a KOL agency in China, can help you identify the right influencers, craft culturally relevant campaigns, and navigate the complexities of the market to ensure your brand’s success.

11. Adapt Quickly to Consumer Needs and Market Changes

When you enter the Chinese market, it’s crucial to adapt rapidly to the high expectations of Chinese consumers. These savvy shoppers not only expect fast deliveries but also demand swift responses to their queries and concerns. This demand for efficiency is driven by the country’s advanced logistics and fast-paced business environment, particularly in major cities.

These savvy shoppers not only expect fast deliveries but also demand swift responses to their queries and concerns.

The expectation of speedy responses is why social media communities are so popular in China. Platforms like WeChat and Weibo allow for instant communication, enabling consumers to be the first to hear about news, promotions, and exclusive discounts. The ability to access multiple apps and communication channels on a single platform further fuels these expectations.

12. Allocate 60% or more of your Budget to Influencers in your Chinese Marketing Strategy

In today’s Chinese marketing trends, allocating at least 60% of your marketing budget to influencers, or Key Opinion Leaders (KOLs) is essential for driving brand success. This substantial investment is necessary for several key reasons.

Firstly, KOLs have a unique ability to create personalized and authentic content that resonates deeply with Chinese consumers. Unlike traditional advertising, which can sometimes feel impersonal, KOLs build trust through their genuine engagement with their followers. This trust translates into higher conversion rates and more meaningful interactions with your brand.

KOLs build trust with their followers through genuine engagement, leading to higher conversion rates and more meaningful interactions with your brand.

Secondly, influencers in China are not just promotional tools—they are trendsetters. They often shape consumer preferences and purchasing decisions, especially among younger audiences who are highly influenced by social media trends. By investing in KOL partnerships, your brand can tap into these trends early and position itself as a leader in the market.

KOLs often shapes consumer preferences and purchasing decisions, especially among younger audiences who are highly influenced by social media trends.

Another compelling reason to dedicate a large portion of your budget to KOLs is the shift towards content-driven marketing in China. Consumers are increasingly seeking out rich, engaging content that provides value beyond mere product information. Influencers excel at creating this kind of content, whether through live streams, product tutorials, or lifestyle integration, making them indispensable to a modern marketing strategy.

Consumers are increasingly seeking out rich, engaging content that provides value beyond mere product information

13. Conclusion

Successfully entering the Chinese market requires a well-rounded strategy that is both adaptive and deeply attuned to local consumer behaviors. From allocating a significant portion of your budget to influencer marketing, to ensuring your brand is localized and responsive to the fast-paced demands of Chinese consumers, every step must be carefully planned and executed. Collaborating with local experts, understanding the digital landscape, and making data-driven decisions are all crucial elements of this journey. With the right approach, your brand can not only enter the Chinese market but thrive in this dynamic and rapidly evolving environment.

Ready to enter the Chinese market?

Let our expert team guide you through every step of the process, from strategy development to execution. Contact us today to start building your brand’s success story in China.

At InfluChina, we help global brands turn China’s complexity into opportunity. From market entry strategy to KOL collaborations and localized digital marketing, our team bridges cultures and builds strategies that deliver real growth in the Chinese market.

FAQ

FAQ: Enter The Chinese Market

What is the most important factor to consider when entering the Chinese market?

The most important factor is understanding and adapting to local consumer behavior. This includes localizing your brand, choosing the right marketing channels, and collaborating with Key Opinion Leaders (KOLs) who resonate with your target audience.

Do I need a local partner to enter the Chinese market?

Most brands benefit from local partners because China’s platforms, consumer expectations, and operations move fast. Partners (agencies, TPs, distributors) help with localisation, platform execution, compliance, customer service, and KOL/KOC programs—while your team keeps control of the brand.

How important is local partnership for entering the Chinese market?

Local partnerships are crucial. Working with a knowledgeable marketing agency and a reliable trading partner (TP) can help navigate the complex market environment, ensure culturally resonant branding and messaging, and manage e-commerce and logistics effectively.

What are the main entry routes to enter the Chinese market?

The most common routes are:

Cross-border eCommerce (CBEC): faster entry and lower setup, good for testing demand

Domestic eCommerce: higher commitment but faster shipping and stronger long-term scale

Distributor / retail partner: faster access to networks but lower brand control

Offline-first / hybrid: best for premium/experiential categories but higher cost and slower scaling

Cross-border or domestic: which is better for market entry?

Cross-border is better when you want to test the market with lighter setup and imported positioning. Domestic is better when you’re ready to scale long-term with faster delivery and deeper platform integration. Many brands start cross-border and expand into domestic once performance proves the business case.

How do I know if there’s demand for my product in China?

You can validate demand by combining platform signals (competitor performance, pricing, reviews, trending content) with research such as consumer surveys, interviews, and digital listening. The goal is to confirm who your buyers are, what problem you solve, and what would block purchase (price, trust, delivery, product understanding).

What does “localisation” actually mean in China?

Localisation is not just translation. It includes a Chinese brand name, China-specific positioning, Chinese product pages (benefits, usage, FAQs), platform-appropriate visuals, reviews and social proof, Mandarin customer service readiness, and early trademark/IP protection.

How long does it take to successfully enter the Chinese market?

You can plan and launch an entry in months, but meaningful success takes consistent execution. A practical way is to follow a 90-day plan: validate and prepare (days 1–30), build trust and channels (days 31–60), then launch and optimise (days 61–90). After that, scaling depends on results and budget.

What KPIs should I track in the first 90 days?

Track KPIs that tell you whether you’re building a scalable engine:

Traffic sources (where discovery comes from)

Conversion rate (product-market fit and listing effectiveness)

Add-to-cartiver & wishlist (purchase intent)

Ratings and reviews (trust and reputation)

Customer service response time (operational readiness)

Repeat purchase / retention (early sign of long-term potential)

What are the biggest mistakes foreign brands make in China market entry?

Common mistakes include treating China as one market, copying Western messaging, choosing the wrong entry route, delaying trademark/IP protection, scaling influencers before product pages/logistics/service are ready, and failing to iterate quickly based on data.

How should I choose marketing and sales channels in China?

Start with your audience and category. Most successful entries combine:

One conversion channel (eCommerce platform)

One discovery channel (social content platform)

One trust layer (reviews, UGC, KOC/KOL, community credibility)

How much of my marketing budget should I allocate to influencers in China?

It is recommended to allocate at least 60% of your marketing budget to influencers (KOLs). Their ability to build trust and engage authentically with Chinese consumers makes them essential for successful brand penetration and growth.